Authors: Tyler Teske, Will Rosellini, Marcelo Forgas

1.0 Highlights

-

Figure AI: Raised over $750M, seeking a $39.5B valuation, yet holds only two patent filings. Most capitalized, yet one of the least defensible from an IP standpoint.

-

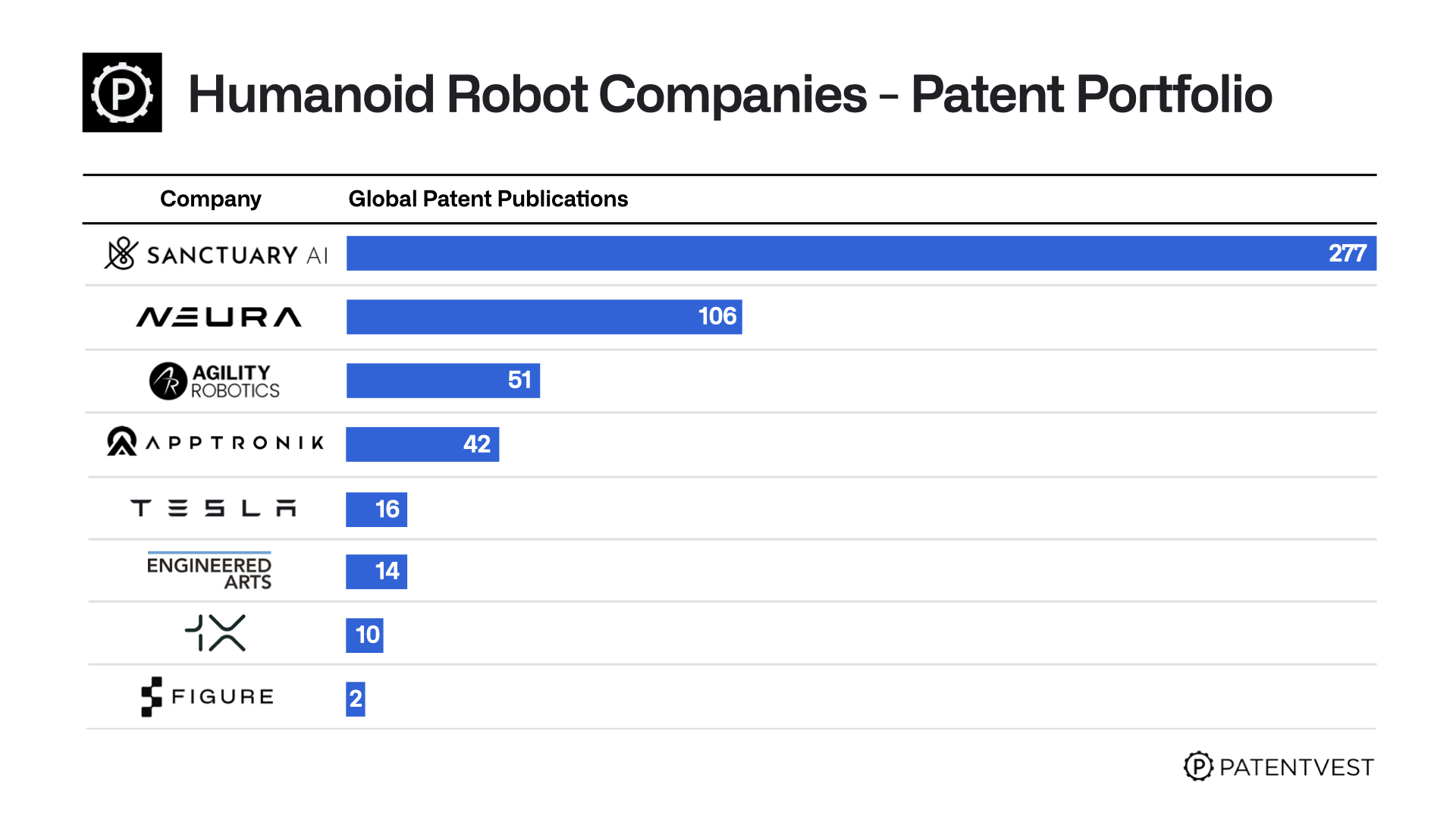

Sanctuary AI: Clear category leader with 77 patent families, with real-world deployments across logistics, retail, and manufacturing. In the global IP landscape, Sanctuary is the only startup in the top 20 patent holders. Everyone else is a legacy industrial or Asian giant. This positions Sanctuary with rare defensibility in a crowded market.

-

Apptronik: Technically strong hardware portfolio with proprietary actuators and active pilots in logistics and manufacturing.

-

Agility Robotics: Industry first-mover with active commercial deployments. IP portfolio is strategically focused on bipedal mobility and logistics integration.

- IP Defines Staying Power: Startups built on vision alone rarely last without strong technical moats.

-

Visibility ≠ Viability: Demos make headlines, but without IP or deployment, they won’t survive the correction.

-

Asia Leads the Global IP Race: China leads with over 7,000 humanoid patent families. Japan and South Korea push the region’s share to over 65% of global filings.

The last 24 months have marked a turning point in humanoid robotics. Startups promising general-purpose labor platforms are attracting serious attention. Investors from Big Tech to Tier-1 VCs are betting that humanoid robots will redefine logistics, manufacturing, and service labor. But funding tells only half the story.

Our benchmarking reveals a market in disequilibrium. Valuations are surging, but IP coverage is thin. Product videos abound, but commercial deployments are rare. Most startups are building fast, but few are building defensibly.

The standout exception is Sanctuary AI, which combines a robust patent portfolio, real-world deployments, and full-stack architecture. Figure AI stands in stark contrast. It is the most capitalized, yet the least protected.

The strategic outlook is clear. The current market rewards visibility. The next market will reward defensibility. Investors should expect a correction, where narrative-heavy players without IP moats face margin pressure, copycat risk, or acquisition dependency. For founders, the takeaway is direct: IP is no longer optional. It is the asset class.

2.0 Executive Summary

Humanoid robots are entering commercial reality. With rapidly falling costs, AI breakthroughs, and pilot deployments, Wall Street sees a multi-trillion-dollar market—but investor capital has dangerously outpaced actual technical readiness and IP defensibility.

The Opportunity

- Projected market size: $38B–$7T+ (Goldman Sachs, Citi, ARK Invest).

- Accelerants: AI integration, 40% component cost reduction, supply chain maturation.

- Impact: A fundamental shift across logistics, manufacturing, healthcare, and more.

Capital vs. Readiness: A Dangerous Gap

- Over $2.1 billion invested in humanoid startups within just two years.

- Figure AI alone raised $754M, targeting a $39.5B valuation.

- Yet nearly all funding is directed toward prototypes lacking meaningful patent protection or commercial validation.

Competitive Landscape: Leaders, Challengers, and Pretenders

- Sanctuary AI: Category Definer & Current Leading Innovator – field-tested deployments, full-stack technology, strongest global IP.

- Neura Robotics: Potential Category Leader – cognitive robotics, robust global filings, cutting-edge AI architecture.

- Apptronik: Mechanically Defensible – strong hardware IP but limited software protections.

- Agility Robotics: Execution-Led Commercial First-Mover – with validated logistics deployments and tightly focused IP around bipedal mobility and integration.

- Tesla Optimus: Engineering-Driven but Strategically Thin – in-house innovation with narrow IP and no external validation.

- Figure AI: Narrative-Driven Hype Machine – with the most capital and the least defensible IP position, reliant on vision over protection.

The flashiest demos do not equal technical or strategic strength.

Global IP Battlefield

An extensive analysis of 11,141 patent families across 1,794 organizations reveals stark realities:

- Corporate IP Leaders: Sony, UBTECH Robotics, Honda, Toyota, Samsung, Hyundai, Alphabet, Kawasaki, SoftBank, and Sanctuary AI.

- Academic IP Foundations: Tsinghua University, AIST (Japan), Beijing Institute of Technology, Osaka University, KAIST, and The University of Tokyo.

- Jurisdictional Strongholds: China, Japan, and South Korea collectively account for over 65% of all humanoid robotics IP.

Strategic Implications

- Massive rounds are backing IP-light companies with untested execution.

- Long-term market leaders will have defensible architectures, demonstrable deployments, and comprehensive global IP protection.

- Current funding structures dangerously misalign with reality—a correction is imminent.

3.0 The Big Picture: Human Robotics Market Overview

3.1 Why the Market Is Too Large to Ignore

Humanoid robots are now modeled by Wall Street as a meaningful slice of the future labor economy:

- $38 billion in annual revenue by 2035 – Goldman Sachs’ base-case TAM for humanoids, revised up more than six-fold in 2024 after faster-than-expected AI progress and a 40 % drop in component costs. 1.4 million units shipped in 2035 under the same forecast, establishing a beachhead for large-scale adoption.

- $7 trillion market by 2050 CITI driven by adoption in home services, eldercare, parcel delivery, and construction.

- $4.85 trillion TAM by 2035 – estimate Global X ETFs estimates across industrial and consumer categories.

- Multi-trillion-dollar long-run upside if humanoids become the default infrastructure for physical work (ARK )

These projections assume robots that can slot into human environments and substitute for high-cost, hazardous, or unmet labor demand across manufacturing, logistics, and services.

3.2 Why Now — Three Catalysts Converging

3.3 What Makes a Humanoid Robot Work: Defining the Full Humanoid Technology Stack

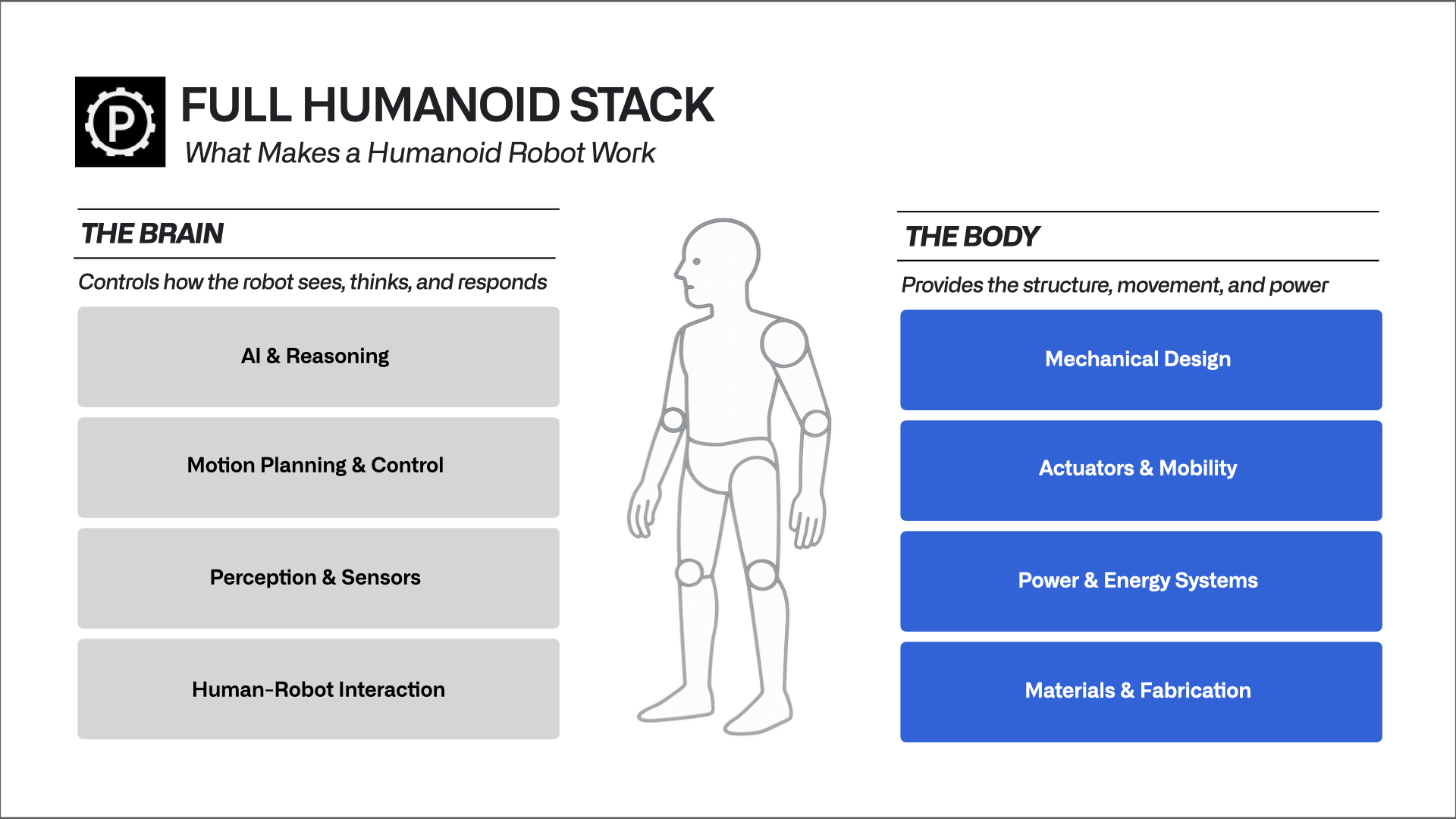

The full humanoid technology stack refers to the complete, vertically integrated set of subsystems that enable autonomous, general-purpose physical labor by a humanoid robot in unstructured human environments. This includes hardware, software, and cognitive intelligence layers working in concert. Humanoid robots are not mechanical shells. They are complex systems that blend high-performance actuation, real-time control software, and adaptive artificial intelligence. To function independently in the real world, these systems must be tightly integrated across multiple technical domains.

- Mechanical Architecture: The foundation is a human-like frame with a head, torso, arms, and legs, designed to replicate human mobility and manipulation. Actuators – whether hydraulic, electric, or elastic – drive motion across joints. Bipedal locomotion systems provide walking, balancing, and terrain adaptation capabilities.

- Control Systems: Microcontrollers and embedded processors handle low-level decision-making, motion planning, and feedback processing. These systems manage joint movement, balance correction, and task execution. Middleware platforms such as ROS coordinate communication between hardware components and higher-level behaviors.

- Perception and Sensors: To operate in human environments, humanoids rely on a full sensory suite. Cameras, depth sensors, and LiDAR provide spatial awareness. Tactile and force sensors enable object interaction. Additional inputs like audio, infrared, and proximity sensors support safety and context awareness.

- Artificial Intelligence: The cognitive layer interprets input and produces behavior. Humanoids combine traditional control logic with learning-based models such as reinforcement learning, imitation learning, and large-scale multimodal AI. These systems support generalization across tasks, language understanding, and adaptation to new environments.

- Human-Robot Interaction: Humanoids designed for shared environments must interpret and respond to people. Speech recognition, facial expression tracking, and gesture analysis allow for natural interaction. Emotion recognition systems can improve trust and performance in healthcare, retail, and service settings.

- Power and Energy Systems: Runtime, safety, and field readiness all depend on energy design. Battery architecture, thermal management, and intelligent power routing determine how long and how safely a robot can operate without interruption.

- Materials and Fabrication: Material selection affects durability, safety, and cost. Lightweight composites and modular components improve mobility while enabling manufacturability at scale. Fabrication techniques such as 3D printing and bio-inspired joint design support flexibility in both development and deployment.

3.4 Applications & Use-Case Segments: Where Humanoids Go to Work First

While the use-case map for humanoids is broad, not every application creates equal opportunity or defensibility. Some are limited by cost, safety, or integration complexity. Others, like logistics, manufacturing, and healthcare, represent high-value labor categories where humanoids could become entrenched infrastructure. The winners will be the ones who target high-value use cases and build for defensibility from day one.

3.5 Early Capital Flows Signal Investor Conviction

Morgan Stanley counts 52 % of the Humanoid 100 already “reported to be involved” in humanoid programs, with the remainder flagged as likely entrants. The same report documents a sharp uptick in corporate transcripts and news mentions beginning in mid-2023, coinciding with multi-hundred-million-dollar private rounds for Figure AI and Agility Robotics. The numbers confirm that humanoid robotics is no longer a fringe R&D topic; it has crossed the threshold where institutional research, component supply chains, and investor capital treat it as a near-term, multi-billion-dollar opportunity. Detailed investor exposure and company-level implications follow in Sections 4.0 (Capital & Investor Snapshot) and 5.0 (Competitive Landscape). The scale and momentum are undeniable. The question now is who’s actually building the robots – and whether they can deliver.

4.0 Capital & Investor Snapshot

The humanoid robotics sector has rapidly become one of the most capitalized and scrutinized segments in emerging tech. Recent months have seen a sharp rise in both funding activity and media attention, with several companies now seeking or closing multi-billion-dollar valuations before reaching commercial scale. That dynamic has started to draw attention from more skeptical voices.

Figure AI is a clear example. Founded in 2022, the company is reportedly seeking $1.5 billion at a $39.5 billion valuation – a fifteenfold increase over the prior year. Its vision is bold: deploy over 200,000 robots by 2029 and generate $9 billion in revenue. But it’s not alone. Agility Robotics is reportedly raising $400 million. Apptronik recently secured $350 million.

Taken together, these companies represent some of the most aggressive fundraising efforts in frontier hardware. Total disclosed funding across the top eight players now exceeds $2.1 billion. And critically, most of this capital is flowing into companies that are still pre-scale, raising not on traction, but on vision, prototype footage, and strong investor networks.

This mix of ambition and uncertainty is what prompted our analysis. The space is clearly attracting capital, but are the companies behind the headlines commercially ready, technically differentiated, or defensible? This section provides a structured evaluation of company-level dynamics: who’s raising, who’s backing them, and what that signals about where the real opportunities and risks may lie.

How to Read The Following Tables

The tables below are intentionally ordered based on each company’s IP defensibility, not by valuation or funding size. This layout reveals which investors are placing bets on strong, protectable platforms versus those backing momentum plays with little underlying protection. In effect, this is not just a company ranking. This raises a strategic question for investors: Who is underwriting protectable value, and who is exposed if momentum fades? The result is more than a ranking of companies. It is a signal of which investors are aligned with durable platforms and which are chasing narrative risk.

4.1 Capital Flows by Company IP Ranking

4.2 The Investors Behind the Bets

5.0 Competitive Landscape

How We Think About Leadership

We believe the companies that will be the leaders in humanoid robotics are not the ones with the biggest rounds or the best-produced demos – they’re the ones with real technical differentiation and defensible intellectual property. A working prototype is just the starting point.

What matters is whether the technology is truly novel, whether it solves something others can’t, and whether it’s protected in a way that creates leverage. Execution matters – but so does ownership. The leaders will be the ones who build with intention and protect what they build. We believe the most important signals of long-term leadership include:

- A core invention others can’t easily replicate

- A patent strategy that protects and expands that invention

- Commercial pilots or early deployments that validate product-market fit

- A go-to-market plan grounded in execution, not just narrative

Plenty can raise capital; far fewer can protect what they build and turn it into durable market position.

What We Evaluated & Why It Matters

The humanoid robotics sector is filled with companies that look impressive – sleek hardware, viral demos, charismatic founders. But very few of these signals correlate with long-term leadership. That’s why we built a different kind of lens.

This analysis doesn’t just map who raised the most money or made the most noise. It evaluates who is actually positioned to lead, based on a multi-dimensional framework rooted in technical defensibility, go-to-market readiness, and IP strength.

What We Analyzed

- 10 leading companies across the humanoid robotics sector

- Funding data and valuation milestones

- Patent families, jurisdictions, and claim breadth using PatentVest

- Product architecture: actuation systems, software stacks, human-robot interaction layers

- Pilots and partnerships: real deployments vs. internal demos

- Go-to-market models: commercial use cases, distribution plans, manufacturing scale

Each company profile includes a trait-by-trait analysis, funding overview, and strategic verdict – framed not by their narrative, but by their execution and defensibility.

Each profile includes an overview, robot details, key applications, pilot programs, and notable announcements or partnerships. Companies are categorized into relevant buckets such as established firms, startups, and tech entrants.

Company Profile: Sanctuary AI

Funding: $140M+ | HQ: Vancouver, BC | Founded: 2018 | sanctuary.ai

Company Overview

Sanctuary AI is building general-purpose humanoid robots designed to perform physical labor in human environments. The company’s mission is to address global labor shortages by creating human-equivalent systems – robots that replicate both the cognitive and physical capabilities of human workers.

Product / Technology

Sanctuary’s system combines Phoenix, its humanoid robot, and Carbon, its AI control platform. Phoenix is designed for general-purpose labor, with a modular, human-scale body and 21-degree-of-freedom hands capable of fine manipulation. Its miniaturized hydraulic actuators deliver high force density in a compact form, enabling the robot to operate in existing environments without infrastructure changes. Carbon functions as the adaptive software layer, integrating vision, audio, and tactile inputs with symbolic reasoning and natural language understanding to execute real-world tasks. The company claims new tasks can be trained in under 24 hours via simulation and human demonstration, allowing faster deployment cycles than traditional automation. Sanctuary positions this stack as a flexible, updatable labor platform that can scale across sectors over time.

Applications / Use Cases

Sanctuary targets tasks across retail, manufacturing, logistics, and healthcare, particularly roles requiring human-like dexterity, adaptability, and reasoning. Phoenix is designed to operate in dynamic, real-world settings where traditional automation struggles, including merchandise handling, inspection, packing, patient assistance, and facility support.

Real-World Pilots and Clients

Sanctuary is among the only companies with documented deployments of a general-purpose humanoid robot. In its pilot with Canadian Tire Corporation, Phoenix completed over 100 in-store tasks, including inventory checks, merchandise folding, and labeling. In parallel, the company is working with Magna International to integrate Phoenix into live automotive production environments for inspection and assembly tasks. Across more than 15 industries, Phoenix has performed over 400 distinct tasks in logistics, warehousing, healthcare, and manufacturing, many of which transitioned from teleoperation to autonomy within 24 hours.

Partnerships

Sanctuary has formed execution-focused partnerships across manufacturing, infrastructure, and AI development. Magna International is both a strategic investor and industrial partner, working closely with Sanctuary on deployment within factory workflows. Microsoft supports the development of embodied AI systems and simulation infrastructure through Azure. NVIDIA provides simulation capabilities via Isaac Lab, enabling Sanctuary to train complex manipulation tasks in virtual environments. Accenture Ventures contributes enterprise channel access, helping Sanctuary explore deployment pathways in retail, logistics, and healthcare.

Funding and Investors

To date, Sanctuary has raised approximately $140 million. Its most recent round was a $58.5 million Series A in November 2024. The company’s last publicly disclosed valuation was $120.8 million, reported in 2022. Investors include Bell, Evok Innovations, Export Development Canada, Magna International, SE Health, Verizon Ventures, Workday Ventures, BDC, InBC Investment Corp, Accenture Ventures, and the Strategic Innovation Fund (Canada).

IP Portfolio Overview

Sanctuary’s IP portfolio includes 77 patent families, 277 publications, and filings across seven jurisdictions: the United States, Canada, the European Patent Office, WIPO, Japan, China, and Australia. The company’s filings span dexterous hands, modular body systems, hydraulic actuators, sensor fusion, and cognitive AI control. The portfolio reflects an effort to protect both the hardware and software layers required for full-stack humanoid performance.

IP Commentary

Sanctuary’s IP strategy appears deliberately aligned with its commercialization goals. Claims focus on core system elements and suggest an architectural approach, designed to protect integration points and enable platform defensibility. The breadth of filings across jurisdictions supports global scalability, while the depth of coverage across hardware and AI positions the company for differentiation in enterprise integration, licensing, or future acquisition. Compared to many peers, Sanctuary’s IP appears unusually coherent relative to its product roadmap and deployment strategy.

Verdict: Category Definer & Leading Innovator

Sanctuary is the first company to combine real-world deployments, full-stack technical depth, and a globally structured IP strategy. With a global patent portfolio spanning 77 families and covering both hardware and cognitive AI, Sanctuary is one of the only players protecting the full humanoid stack. Backed by strategic partners and validated through real-world deployments, it represents the most complete and defensible platform in the space. If its trajectory holds, it is well-positioned to become a defensible platform in the humanoid robotics market.

Company Profile: Neura Robotics

Funding: $123M (€120M) | HQ: Metzingen, Germany | Founded: 2019 | neura-robotics.com

Company Overview

Neura Robotics develops cognitive humanoid robots designed for close human interaction across industrial, service, and domestic environments. The company’s mission is to merge advanced mechatronics and embedded AI to create autonomous machines capable of perceiving, learning, and making real-time decisions safely and intuitively.

Product / Technology

Neura’s flagship humanoid robot, 4NE-1, is built for human-centric spaces and general-purpose collaboration. Standing 180 cm tall and weighing 80 kg, 4NE-1 features a 15 kg payload capacity, swappable forearms, and a human-like form factor suited for daily use in work and living environments. The system is built on the NEURAverse platform and powered by MAINDRIVE, a distributed control architecture with embedded neural processors at each joint. This enables low-latency, real-time decision-making without reliance on cloud compute. 4NE-1 incorporates a wide array of sensing technologies, including 3D vision, gesture and object recognition, force-torque feedback, and a proprietary touchless human detection system that enables safe physical proximity without direct contact. Its AI API supports natural language interaction and continuous learning, while its modular design and high sensory fidelity make it adaptable to a broad range of roles. Neura positions 4NE-1 not as a task-specific robot, but as a general-purpose assistant capable of scaling across industries and daily life.

Applications / Use Cases

Neura is targeting real-world roles in logistics, manufacturing, healthcare, and hospitality environments that require both physical adaptability and close interaction with humans. Use cases include machine tending, material transfer, hospital logistics, eldercare support, front-desk reception, and light facility operations. The company also sees long-term opportunity in in-home assistance and personal robotics.

Real-World Pilots and Clients

Neura has piloted 4NE-1 in German manufacturing facilities for machine interface operations and part transfer. In healthcare, the robot has been tested in hospital environments and eldercare facilities, supporting logistics and daily assistance. Demonstrations have also been conducted in hospitality settings, including concierge-style deployments. These pilots focus on validating the robot’s ability to operate safely and autonomously in shared human spaces.

Partnerships

Neura collaborates with a network of industrial and academic partners to advance both hardware and cognitive systems. The company works with Delta Electronics on joint mechatronics development and is backed by the Volvo Cars Tech Fund for projects related to robotic perception and mobility. Its AI models and human-robot interaction strategies are co-developed with European university research teams, reinforcing its edge-compute focus and safety-driven design approach.

Funding and Investors

Neura Robotics has raised approximately $123 million to date. Its most recent round was a €120 million Series B in January 2025. The company’s latest reported valuation is $500 million. Investors include Lingotto Investment Management, BlueCrest Capital, Volvo Cars Tech Fund, InterAlpen Partners, Vsquared Ventures, HV Capital, Delta Electronics, CD Ventures, L-Bank, and founder David Reger.

IP Portfolio Overview

Neura’s IP portfolio includes 28 patent families and 106 published documents, with filings across 11 jurisdictions: the United States, Germany, Taiwan, the European Patent Office, WIPO, Australia, China, Japan, Canada, Brazil, and South Korea.

IP Coverage

The company’s filings cover embedded actuation control, sensor integration, AI-based perception, and joint-level cognition. The portfolio protects both physical components and cognitive control systems, with an emphasis on edge-based processing and safe human-robot interaction. The breadth of jurisdictional coverage reflects Neura’s intention to commercialize globally across both industrial and service domains.

IP Commentary

Neura’s portfolio shows clear alignment with its positioning in cognitive robotics. Rather than filing broadly on generic hardware, the company focuses on the system-level coordination between perception, embedded AI, and mechanical response. Its patents are structured around real-time autonomy and safe collaboration—core elements of its product architecture. With filings across Europe, Asia, and North America, Neura appears to be actively protecting its differentiation in localized, edge-driven robot intelligence. Compared to peers with narrower or more speculative filings, Neura’s IP is targeted, integrated, and commercially relevant.

Verdict: Potential Category Leader

Neura Robotics has built a full-stack humanoid platform with credible differentiation in embedded intelligence and real-time safety. Its IP footprint supports a defensible position in cognitive robotics, and its growing track record of industrial and healthcare pilots reinforces commercial viability.

Company Profile: Apptronik

Funding: $431M | HQ: Austin, TX | Founded: 2016 | apptronik.com

Company Overview

Apptronik is developing general-purpose humanoid robots for logistics, manufacturing, and high-churn industrial environments. Spun out of the Human Centered Robotics Lab at the University of Texas, the company emphasizes scalable design, rapid manufacturability, and safe human interaction. Its approach centers on real-world use cases that demand both mobility and manipulation.

Product / Technology

Apptronik’s flagship robot, Apollo, is a full-body humanoid designed for structured commercial environments. Apollo stands 5’8” tall, weighs 160 pounds, and features 22 degrees of freedom. It uses proprietary linear actuators – a departure from the rotary actuators used by most competitors, which the company claims offer smoother, safer, and more efficient movement. The robot can lift up to 25 kg and is powered by hot-swappable batteries for continuous uptime. The system is modular and built for mass production, with a plug-and-play architecture that supports quick repair, customization, and integration into existing workflows. Apptronik combines autonomous routines with remote supervision, supporting gradual rollout of capabilities and alignment with safety requirements in human-occupied spaces.

Applications / Use Cases

Apptronik is targeting logistics, warehousing, and light manufacturing environments – especially those where conventional automation has failed due to layout complexity or task variability. Initial use cases include tote handling, material transport, kitting, and last-meter fulfillment. The company has also expressed interest in expanding into field services and utility support.

Real-World Pilots and Clients

Apptronik has launched multiple pilots to validate Apollo’s commercial readiness. In 2023, the company began testing with Mercedes-Benz in automotive factory settings. In 2024, it piloted Apollo in warehouse workflows with GXO Logistics, and in early 2025 announced a strategic manufacturing partnership with Jabil to support scaled production. Apptronik has also conducted government-focused demonstrations around mobile manipulation and collaborative robotics.

Partnerships

Key partners include Mercedes-Benz for enterprise deployment, Jabil for scaled contract manufacturing, and a legacy partnership with NASA from the DARPA Robotics Challenge era. The company also works with safety and control system providers to support Apollo’s transition from prototype to production-ready platform.

Funding and Investors

Apptronik has raised $431 million to date, including a $350 million Series A in February 2025. The company’s latest reported valuation is $1.5 billion. Investors include ARK Invest, Assembly Ventures, B Capital, Capital Factory, Google, Mercedes-Benz, Perot Jain, Samsung Next, and others.

IP Portfolio Overview

Apptronik holds 17 patent families and over 50 published documents across the United States, Europe, Canada, and WIPO. The portfolio reflects a focused effort to protect the company’s key hardware differentiators, particularly in actuation and joint-level design, rather than broad platform-level abstractions.

IP Coverage

Apptronik’s IP spans four core areas: proprietary linear actuation systems that underpin Apollo’s movement architecture; compact series elastic actuators (SEAs) optimized for power density and force control; biomechanically inspired joints and modular limbs; and early software architectures for coordinating tasks across humanoids and mobile platforms. Beyond its mechanical focus, the portfolio includes early filings on control software and humanoid-to-AMR workflows in commercial settings. Paired with active pilot programs, Apptronik is one of the few companies with IP coverage and integration experience across both the design and operational layers of humanoid robotics. Technically strong and closely aligned with its execution strategy, Apptronik’s IP demonstrates real depth in subsystems critical to Apollo’s viability, particularly in actuation, joint compliance, and mechanical safety.

Verdict: Mechanically Defensible

Apptronik has built a technically strong IP portfolio that protects the core subsystems behind Apollo’s distinctive architecture, including proprietary actuation, compliant joints, and mechanical safety features. The portfolio aligns closely with the company’s product strategy and supports real-world integration, positioning Apptronik as a credible leader in the deployment of humanoid robotics.

Company Profile: Agility Robotics

Funding: ~$244M (publicly disclosed) | HQ: Salem, OR | Founded: 2015 | agilityrobotics.com

Company Overview

Agility Robotics develops bipedal humanoid robots designed for real-world deployment in logistics and warehouse environments. Founded as a spin-out from Oregon State University, the company focuses on building systems that operate in existing human-centric spaces without infrastructure changes.

Product / Technology

Its flagship robot, Digit, is designed to walk, carry loads, and execute tasks such as tote handling in dynamic, semi-structured environments. Standing 5’9″ with a 35 lb payload capacity, Digit is intended to work in environments originally built for humans. It integrates with Agility Arc™, a proprietary software platform that manages robot fleets and connects with warehouse management systems. Digit has been featured in Time Magazine’s Best Inventions of 2024 and Fast Company’s Most Innovative Companies list. Unlike many humanoid initiatives still in the demo phase, Digit has been deployed for pilot work with real companies in the logistics sector.

Applications / Use Cases

Agility is focused on logistics and supply chain applications, especially in warehouses and distribution centers. Key use cases include tote handling, item sorting, pallet staging, and last-meter delivery within fulfillment workflows. The company emphasizes operational flexibility, positioning Digit as a solution for dynamic environments where fixed automation is cost-prohibitive or infeasible.

Real-World Pilots and Clients

Agility is one of the few companies with formal commercial deployments of humanoid robots. Its most notable client is GXO Logistics, which signed a multi-year agreement in 2024 to deploy Digit robots across warehouse operations. Agility also launched pilot programs with Amazon and Spanx, testing Digit in material handling and assembly-line support roles. These pilots represent the first large-scale humanoid robot deployments. Agility is one of the few companies to have publicly confirmed field deployments of humanoid robots. It has worked with Amazon and GXO Logistics, both of which have piloted Digit for warehouse operations. GXO has confirmed operational trials of Digit at a Spanx facility. Amazon’s involvement has been covered via the Amazon Industrial Innovation Fund, which lists Agility as a portfolio company. In 2024, Agility opened RoboFab, its humanoid robot manufacturing facility in Salem, Oregon, with a stated capacity of 10,000 units per year—reportedly the first of its kind.

Partnerships

Agility has announced partnerships with leading tech providers, including NVIDIA, Microsoft, Google DeepMind, and OpenAI, focused on AI capabilities and integration infrastructure. It also collaborates with Manhattan Associates and Ricoh USA on software integration and fleet maintenance, respectively.

Funding and Investors

Agility has raised approximately $320 million to date. Its most recent round – an estimated $150 million – closed in April 2025. The company’s latest reported valuation is approximately $1.75 billion. Investors include WP Global Partners (lead), SoftBank, Amazon Industrial Innovation Fund, Playground Global, and DCVC.

IP Portfolio Overview

Agility Robotics holds 17 patent families and 51 published documents across eight jurisdictions: the United States, the European Patent Office, Japan, the World Intellectual Property Organization (WIPO), Canada, Austria, Australia, and Germany.

IP Coverage

Agility’s filings concentrate on the mechanical systems that enable humanoid robots to operate reliably in real-world environments. Core claims span spring-mass-inspired walking, compliant foot assemblies for impact absorption, and bipedal balance control, providing a functional edge in navigating human-designed spaces. The portfolio also covers precision actuator sensing, strain-wave and cycloid drive architectures for compact joint performance, and vehicle-integrated deployment systems for logistics and delivery. Additional protections extend to object handling through torso-supported load stabilization and specialized gripping mechanisms. Collectively, these patents anchor Agility’s differentiation in legged mobility, structural integration, and task execution within industrial workflows.

IP Commentary

Agility’s IP portfolio is highly focused, with clear alignment between its engineering strengths and claim scope. Rather than broad platform claims, the company has prioritized protectable innovations in locomotion architecture, drivetrain mechanics, and deployment-specific subsystems. This targeted approach supports real-world execution, with patents that defend how the robot walks, lifts, and integrates into customer operations. The portfolio’s precision reflects Agility’s go-to-market focus on the physical and functional interface between humanoids and logistics infrastructure.

Verdict: Execution-Led Commercial First-Mover

Agility Robotics is the first humanoid company to reach operational deployment with enterprise customers. Its IP portfolio, though tightly scoped, is well-matched to its commercial strategy, focusing on the mechanics of movement, integration, and reliability. Combined with manufacturing readiness, safety compliance, and pilot traction, this positions Agility as a credible and defensible early leader in warehouse-grade humanoid robotics.

Company Profile: Tesla

Funding: Public (NASDAQ: TSLA) | HQ: Austin, TX | Founded: 2003 (humanoid project launched in 2022) | tesla.com/AI

Company Overview

Tesla Optimus is the company’s humanoid robotics initiative, launched in 2022 with the goal of automating repetitive and physically demanding labor across Tesla’s own factories and, eventually, broader industrial and consumer markets. Positioned as an extension of Tesla’s vertically integrated AI and hardware stack, Optimus draws on the company’s existing technologies in electric actuation, battery systems, and autonomous software.

Product / Technology

The current Optimus prototype is a full-body humanoid robot approximately 5’8″ tall, weighing 125 pounds, with 28 degrees of freedom and a 2.3 kWh battery that provides up to 8 hours of runtime. It features custom Tesla-designed servo motors and tendon-driven hands with 11 degrees of freedom, aimed at mimicking human dexterity. Optimus is powered by Tesla’s in-house AI stack, including the Dojo supercomputer and vision-based learning models adapted from its Full Self-Driving (FSD) systems. Motion planning and manipulation are trained using auto-labeled video datasets and physics-based simulations. Tesla claims that Optimus will eventually support general-purpose functionality and human-level autonomy, although current capabilities remain tightly scoped. The platform is designed for manufacturability and cost-efficiency, leveraging Tesla’s existing automotive production infrastructure. The company has publicly stated a long-term target price under $20,000, with eventual plans for consumer ownership.

Applications / Use Cases

Initial applications are focused on automating repetitive tasks inside Tesla’s own production facilities, including box handling, material movement, and basic line-feeding. Longer-term ambitions include use in logistics, retail restocking, and in-home assistance. Tesla positions Optimus as a general-purpose labor solution that could scale into both enterprise and personal markets.

Real-World Pilots and Clients

To date, all Optimus deployments have been internal to Tesla. The robot has been tested in the Fremont and Texas factories on tasks such as object transport and part organization. Demos have shown Optimus folding laundry, handling eggs, and walking with stability. While no commercial clients have been named, the company has signaled plans for broader enterprise deployment once reliability improves.

Partnerships

Optimus is developed entirely in-house using Tesla’s vertically integrated stack, spanning chip design, actuation, battery systems, AI models, and manufacturing. While Tesla has occasionally cited academic collaborations around robotics safety and motion planning, the Optimus initiative does not rely on external partnerships or component sourcing in the way most startups do.

Funding and Investors

Optimus is internally funded by Tesla and does not have separate capital raises or valuation disclosures. Tesla’s broader AI investments – including Dojo, FSD, and AI inference hardware – indirectly support the Optimus program. Investor interest is driven by public statements from CEO Elon Musk and quarterly updates tied to Tesla’s long-term vision of labor automation.

IP Portfolio Overview

Humanoid-related patents in Tesla’s portfolio include 8 patent families and 16 published documents associated with the Optimus program, with filings across the United States and WIPO. These filings have been published over the past two years and correspond to work initiated after the project’s public debut in 2022.

IP Coverage

The portfolio includes inventions related to robotic actuators, tendon-driven hand assemblies, modular limbs, and full-body mechanical structures optimized for manufacturability and balance control. Some filings describe system-level features such as load distribution, joint kinematics, or sensor integration into lightweight robotic arms. Others focus on design elements specific to humanoid operation, including safety-centric compliance mechanisms and energy-efficient actuation strategies.

However, the coverage is relatively narrow in jurisdiction and scope. The filings emphasize mechanical assemblies and design implementation but do not yet extend to software-based autonomy, AI control layers, or generalized behavior modeling.

IP Commentary

Tesla’s IP activity in humanoid robotics reflects an early-stage, engineering-led strategy, focusing on practical hardware innovation rather than platform-level defensibility. The portfolio is consistent with Tesla’s approach of rapid in-house iteration, but it lacks the breadth seen in companies actively positioning for IP leverage through licensing or M&A. While the mechanical claims are technically sound, they do not yet suggest long-term barriers to entry. If Optimus is to become a strategic platform beyond internal deployment, Tesla will need to expand its filings to cover cognitive systems, learning algorithms, and full-stack integration. For now, the portfolio supports prototyping and internal use, but does not establish Optimus as a defensible leader in the category.

Verdict: Engineering-Driven, Strategically Thin

Tesla’s humanoid robotics portfolio reflects a vertically integrated, hardware-focused approach aligned with its in-house engineering model. The company’s eight patent families and sixteen publications cover tendon-driven limbs, modular actuators, and balance systems, offering credible protection for internal development and manufacturability. However, the portfolio remains narrow in scope and jurisdiction, with limited coverage of autonomy, cognitive systems, or full-stack integration. At this stage, Optimus is a technically promising initiative but not yet positioned as a defensible platform.

Company Profile: Engineered Arts

Funding: $16.2M | HQ: Falmouth, UK | Founded: ~2004 | engineeredarts.co.uk

Company Overview

Engineered Arts specializes in expressive humanoid robots built for communication, demonstration, and audience engagement, not industrial labor. Founded in the early 2000s, the company has positioned itself at the intersection of robotics, performance art, and education. Its robots are designed to replicate human facial expressions, speech, and emotional interaction with a high degree of realism.

Product / Technology

The company’s primary platforms, Ameca and Mesmer, are full-body humanoid robots optimized for lifelike expression and interactive behavior. Ameca features 17 facial actuators, a fully articulated upper body, and a modular head system designed to convey micro-emotions in real time. It integrates GPT-based dialogue, vision tracking, and conversational AI to support natural interactions.

Mesmer extends this approach with hyper-realistic silicone skin, muscle-mapped facial control, and embedded sensing for responsive interaction. Both platforms run on Tritium, Engineered Arts’ proprietary OS for real-time control, telepresence, and integration with third-party AI models. The company emphasizes modularity and ease of integration into customer-facing environments such as museums, exhibitions, and corporate events.

While not built for physical labor, these systems are tailored for high-fidelity social interaction and public engagement.

Applications / Use Cases

Engineered Arts serves markets including entertainment, education, marketing, and research. Its robots are used in theme parks, science centers, live demonstrations, and film production. Academic institutions deploy its systems for HRI (human-robot interaction) research and AI embodiment studies. Ameca, in particular, is used as a public-facing platform for conversational AI demos.

Real-World Pilots and Clients

Ameca and Mesmer have been featured in trade shows (CES, GITEX), museum exhibits, and public installations across Europe, Asia, and North America. Deployments include interactive exhibits, branded activations, and long-term research programs. Ameca has gained visibility through viral videos and press coverage for its naturalistic expressions and real-time dialogue integration.

Partnerships

Engineered Arts works closely with creative studios, research institutions, and exhibit designers. It has partnered with OpenAI for GPT-4 integration, and with hardware providers for camera, vision, and actuator subsystems. Its primary partnerships are commercial rather than industrial, focusing on media integration and end-user customization.

Funding and Investors

The company has raised approximately $16.2 million to date. Its most recent round was a $10 million Series A in December 2024. Investors include Helium-3 Ventures. No valuation has been publicly disclosed.

IP Portfolio Overview

Engineered Arts holds 4 patent families and 14 published documents, with filings in two jurisdictions: the United Kingdom and WIPO.

IP Coverage

The portfolio covers robotic facial actuation, expressive motor control, modular skin systems, and user interface methods for embodied interaction. Claims emphasize fine-motion control and lifelike expressiveness rather than physical strength or autonomy. The scope is well-aligned with the company’s niche in social robotics and interactive systems.

IP Commentary

Engineered Arts’ IP is highly specialized and limited in scope. Its filings reflect a clear focus on expressive robotics and user interaction, not mobility, autonomy, or industrial deployment. The portfolio likely provides defensibility in the entertainment and communications segment, but would not offer meaningful barriers to entry in broader humanoid robotics. Still, the patents are technically coherent and reflect genuine novelty in facial actuation and human-robot engagement.

Verdict: Specialist Leader

Engineered Arts is the clear category leader in expressive humanoid robotics. While not a contender in industrial or logistics applications, its mastery of social interaction and its differentiated IP position it well within its chosen niche. The question is not whether it will scale into labor markets—it won’t—but whether its tech becomes the default interface layer for embodied AI in public-facing roles.

Company Profile: 1X Technologies

Funding: $125M+ | HQ: Oslo, Norway | Founded: 2014 | 1x.tech

Company Overview

1X Technologies, formerly Halodi Robotics, is developing humanoid and semi-humanoid robots optimized for real-world deployment in homes, offices, and lightly structured industrial environments. The company focuses on building affordable, safe robotic systems that can integrate into daily life, with a long-term goal of general-purpose labor automation.

Product / Technology

1X’s product line includes EVE, a commercially available wheeled humanoid platform, and NEO, a bipedal humanoid robot currently in development. EVE features a mobile base with humanoid arms, real-time teleoperation, and a cloud-connected learning system, making it suitable for use cases like security, monitoring, and concierge services. NEO is designed as a full bipedal humanoid platform, emphasizing safe actuation, low-cost design, and reinforcement learning integration. While it has not yet entered commercial deployment, NEO reflects 1X’s broader ambition: a general-purpose robot that can operate in everyday environments and assist with basic physical tasks in homes and workplaces. The company’s architecture relies on a hybrid of remote control and supervised learning, with a cloud-based AI stack for model updates and operator feedback integration.

Applications / Use Cases

1X is targeting sectors where human-robot coexistence is critical: security, eldercare, property management, front-desk operations, and in the longer term, domestic assistance. EVE has already been deployed in corporate offices and facility monitoring scenarios. NEO is positioned for future roles involving home tasks, mobility in dynamic spaces, and general-purpose manipulation.

Real-World Pilots and Clients

EVE has been deployed commercially across European office and property management settings, including use in security patrols and receptionist-style roles. NEO is still in the pilot phase, with limited public demonstrations and internal testing. 1X has released preview footage of NEO’s locomotion and manipulation but has not announced field deployments as of early 2025.

Partnerships

1X is backed by leading investors and has established high-profile partnerships. The company collaborates with OpenAI on embodied AI integration and has additional commercial ties to telecom infrastructure and security services firms. These relationships support both product development and potential deployment at scale, particularly as NEO nears readiness.

Funding and Investors

1X has raised more than $125 million, with a $100 million Series B closing in January 2024. Investors include OpenAI, EQT Ventures, Samsung NEXT, Tiger Global, Skagerak Capital, Sandwater, and others.

IP Portfolio Overview

1X holds only 2 patent families with 10 published documents. Its filings span five jurisdictions: the United States, Canada, Japan, the European Patent Office, and WIPO.

IP Coverage

The existing filings are limited and appear to focus on hardware-related systems, including compliant actuation and modular robotic components. However, there is little publicly disclosed coverage of core enabling technologies for bipedal locomotion, cognitive AI control, or general-purpose manipulation.

IP Commentary

1X’s IP position is extremely limited relative to its funding level and technical claims. With only two patent families, the company is heavily underprotected in a field where core system architecture, safety mechanisms, and software control layers are typically guarded through robust portfolios. While the company may be relying on execution speed and proprietary hardware to maintain an advantage, the lack of meaningful IP coverage presents a significant strategic vulnerability, especially as more defensible competitors scale.

Verdict: Well-Funded but Under-Protected

1X has strong backers, early deployments with EVE, and a credible product vision with NEO. But its limited IP activity raises real questions about long-term defensibility. If NEO succeeds, the company may gain market visibility, but without stronger IP, it risks building a high-profile target rather than a protected platform.

Company Profile: PAL Robotics

Funding: Undisclosed | HQ: Barcelona, Spain | Founded: 2004 | pal-robotics.com

Company Overview

PAL Robotics is a long-standing developer of humanoid and service robots, with a particular focus on assistive technology, academic research, and modular platforms for robotics R&D. The company plays a leading role in EU-funded robotics initiatives and is best known for enabling human-robot interaction and mobility support in controlled environments such as hospitals, universities, and labs.

Product / Technology

PAL’s primary platforms include TIAGo, a versatile mobile manipulator robot, and REEM-C, a full-size humanoid designed for research applications. TIAGo combines a mobile base with a 7-DOF arm, vision systems, and a ROS-based software stack. The system is highly modular and widely used in research related to human-robot collaboration, object manipulation, and autonomous navigation. REEM-C is PAL’s most humanoid offering, featuring bipedal locomotion, arm movement, and voice interaction. It is designed primarily for academic research and demonstration purposes, not commercial labor deployment. Both platforms are built for integration with external AI modules, customized interfaces, and experimental sensors, making them ideal for labs, not factories.

Applications / Use Cases

PAL Robotics is active in assistive care, rehabilitation support, service robotics, and academic research. Its robots have been deployed in hospital logistics pilots, eldercare monitoring, and as interactive agents in retail and public spaces. The company’s platforms are also used extensively in EU research projects on cognitive robotics, ambient assisted living, and long-term human-robot interaction.

Real-World Pilots and Clients

PAL’s robots are used in universities and research institutes across Europe, including deployments in medical centers and aging-in-place pilot programs. TIAGo has been used for hospital delivery tasks, patient monitoring, and in-home care research. REEM-C has been deployed in teaching labs, robotics competitions, and HRI testbeds. While PAL’s clients include institutional customers, the company has not announced commercial-scale deployments in industry.

Partnerships

PAL is heavily embedded in EU research consortia and has long-term collaborations with academic institutions across robotics, aging, and healthcare. It participates in Horizon Europe and AAL (Active and Assisted Living) projects, and contributes to ROS-Industrial and other open-source robotics communities. These partnerships support the continuous iteration of PAL’s platforms in R&D-heavy environments.

Funding and Investors

No formal funding rounds or investor disclosures have been made public. PAL Robotics operates as part of the Robotnik Group, which focuses on mobile robotics development and systems integration.

IP Portfolio Overview

PAL Robotics holds a single patent family with 2 published documents. These filings are limited to Spain.

IP Coverage

The company’s filings are narrow and appear to cover platform-level designs and modular robot integration. No publicly disclosed patents cover locomotion, AI, or general-purpose manipulation at a foundational level. PAL appears to rely more on open standards, public funding, and long-term institutional collaborations than proprietary IP.

IP Commentary

PAL’s IP position is minimal and unlikely to support commercial defensibility. The company’s strategy has always been more focused on collaboration, standards contribution, and research visibility than on IP consolidation. While its robots are credible in academic contexts, the lack of a patent foundation will limit commercial scale, particularly outside of EU-funded ecosystems.

Verdict: Research-Grade Specialist

PAL Robotics has been a reliable contributor to assistive and research robotics for nearly two decades. Its platforms are widely used in European R&D, and its software modularity and open integrations have made it a go-to for cognitive robotics pilots. However, with no funding, IP moat, or commercial scale strategy, it is not positioned as a breakout leader in humanoid labor automation.

Company Profile: Collaborative Robotics

Funding: $140M+ | HQ: Santa Clara, CA | Founded: 2022 | co.bot

Company Overview

Collaborative Robotics is developing a non-humanoid, wheeled cobot designed for material handling in logistics, biotech, and commercial environments. Founded by Brad Porter, former head of Amazon Robotics, the company claims to be building a fundamentally new class of robot—one that prioritizes safety, reliability, and deployability over humanoid mimicry.

Product / Technology

The robot is human-scale, runs on four omnidirectional wheels, and uses a proprietary mechanism to move boxes, totes, and carts. Sensors are positioned at eye level to match human perspective, but the company has avoided bipedal designs entirely—citing stability, cost, and throughput as core differentiators. Collaborative claims its robot is “novel,” yet no technical documentation, imagery, or public demos have been released. The product is designed to operate in shared human spaces, but it is not a humanoid and isn’t intended to be one.

Applications / Use Cases

Target use cases include warehouse and lab logistics, cart movement, and point-to-point material transport in environments like healthcare facilities, factories, or biotech labs. The robot is explicitly designed for structured commercial spaces—not rough terrain, unstructured autonomy, or complex manipulation.

Real-World Pilots and Clients

The company claims deployments are underway through its “Cobot Flywheel Program” with customers in logistics, manufacturing, healthcare, and biotech. No named clients, footage, or detailed performance results have been disclosed.

Partnerships

The most visible partnership is with the Mayo Clinic, which is both a strategic investor and a potential end-user. No technical or manufacturing partnerships have been publicly announced. Executive advisor Teresa Carlson (former AWS and Microsoft) adds enterprise experience, but product integration pathways remain unclear.

Funding and Investors

Collaborative Robotics has raised $140M to date, including a $100M Series B in April 2024 and a $30M Series A in 2023. Investors include General Catalyst, Sequoia, Lux, Khosla, Mayo Clinic, and others—making it one of the best-capitalized robotics startups in its class despite being entirely pre-revenue.

IP Portfolio Overview

The company holds 1 patent family and 2 published documents across the U.S. and WIPO.

IP Coverage

Public filings are minimal. No disclosed patents cover locomotion, actuation, control systems, or safety architecture in detail. Given the company’s claims of novelty and secrecy, it’s likely some IP is being held back—but as of now, there is no visible protection around the core of its claimed innovation.

IP Commentary

For a company this well-funded and strategically positioned, the absence of a meaningful patent portfolio is a glaring gap. While stealth may justify early restraint, the complete lack of visible coverage—especially for a hardware company—undermines claims of uniqueness. At this stage, Collaborative has more brand promise than defensibility.

Verdict: Hype-Backed Contrarian

Collaborative Robotics isn’t building humanoids—and that’s the point. It’s raised $140M to bet against the form factor, not join it. But with no public product, minimal IP, and unverified traction, its credibility rests entirely on pedigree and pitch. Until it delivers, it remains a high-profile question mark—not a proven platform.

Company Profile: Figure AI

Funding: $754M | HQ: Sunnyvale, CA | Founded: 2022 | figure.ai

Company Overview

Figure AI is building a general-purpose humanoid robot designed to automate physical labor across industrial and consumer settings. Founded in 2022 by Brett Adcock (co-founder of Archer Aviation), the company has rapidly positioned itself as the most heavily capitalized humanoid robotics startup in the world. With over $750 million raised in under two years and a valuation reportedly pushing $2.6 billion – potentially as high as $39.5 billion – Figure has become a defining example of investor enthusiasm in the sector, even as technical maturity and defensibility remain limited.

Product / Technology

Figure’s core product is a humanoid robot platform that has progressed through three public versions. The first, Figure 01 (2023), was an initial R&D prototype focused on locomotion, system integration, and hardware-software co-development. This was followed by Figure 02 (2024), a refined system featuring integrated cabling, a torso-mounted battery, 25 kg payload capacity per arm, and improved ergonomics. The most recent iteration, Helix (2025), represents the third-generation commercial version and includes 35 degrees of freedom, articulated hands, stereo vision, and a proprietary AI stack called Helix VLA (Visual Language Action). Helix is designed as a general-purpose labor platform, capable of navigation, object manipulation, and multimodal perception. Its AI system combines imitation learning, reinforcement learning, and large language model (LLM)-based reasoning. Figure claims the platform is engineered for scalable deployment across logistics, manufacturing, and consumer use cases.

Applications / Use Cases

Figure positions its robot as a universal labor solution. Claimed applications include warehouse picking and pallet movement, retail restocking, customer interaction, household tasks (e.g., folding laundry), and long-term use in healthcare, hospitality, and even space exploration. The breadth of its narrative, combined with its consumer-friendly branding, has helped attract media and investor attention, even as actual commercial use remains speculative.

Real-World Pilots and Clients

To date, no commercial deployments have been announced. Figure has confirmed pilot testing with BMW Manufacturing at its Spartanburg plant for logistics use cases. Internal warehouse trials include box handling, pick-and-place, and inventory tasks. Demonstrations of Figure folding laundry and performing basic kitchen tasks have been used heavily in marketing and fundraising. Despite the scale of capital raised, there are no third-party data, customers, or technical publications validating the robot’s real-world capabilities.

Partnerships

Figure has announced partnerships with major infrastructure and AI players, including OpenAI for integrating foundation models into physical systems; NVIDIA and Microsoft Azure for simulation, training, and cloud computing; BMW as a pilot deployment partner; and various robotics suppliers to support hardware scaling. However, most of these partnerships appear limited to infrastructure support or early-stage testing, not revenue-generating integration or actual product deployment.

Funding and Investors

Figure AI has raised approximately $754 million in disclosed funding. In February 2024, it secured $675 million in a single round co-led by Microsoft, OpenAI, and NVIDIA, among others. Earlier investors include Parkway Venture Capital, Align Ventures, and Jeff Bezos. The company’s last confirmed valuation was $2.6 billion, but it is rumored to be seeking up to $1.5 billion at a $39.5 billion valuation, according to filings and pitch materials reported in early 2025.

IP Portfolio Overview

Figure AI holds 2 patent families and 2 published documents, all filed in the United States. There are no filings in Europe, Asia, or other international jurisdictions, and no visible coverage of key robotic systems beyond basic structural claims.

IP Coverage

The portfolio does not yet cover motion planning, actuator systems, safety mechanisms, or general-purpose manipulation. No filings exist for AI architecture, learning systems, or coordination across environments. The patents appear to focus on high-level form factor and mechanical design. For a company claiming to be building a foundational labor platform, the lack of technical IP is striking. The company may have filed additional patents in stealth, but as of now, its visible portfolio offers no protection for the systems it claims will define the future of labor automation. This creates both a legal and strategic vulnerability: if Figure succeeds, it will do so with minimal defensibility.

IP Commentary

Figure’s IP position is extremely weak relative to its capital, ambition, and public narrative. The pending application is entirely focused on external design elements and has been formally rejected for lacking novelty and being obvious over known humanoid robot architectures. There are no claims covering Figure’s core technology stack. While it’s possible Figure is holding patents in stealth, the absence of meaningful protection, particularly around its AI stack, suggests a company focused on speed and perception, not long-term defensibility. If the product succeeds commercially, it will become a high-value target with no perimeter.

Verdict: Narrative-Driven Hype Machine

With over $750 million raised and reports of a $39 billion valuation target, Figure is the most capitalized humanoid robotics startup in history. But with no real deployments, no meaningful IP, and no proof of general-purpose functionality, its valuation is built almost entirely on founder pedigree, foundation model associations, and slick videos. If it delivers, it could define the category. If not, it will be the poster child of the humanoid robotics bubble.

6.0 Asia’s Parallel Race

Asian humanoid-robotics players are no longer operating in the background; they’re dominating headlines – and capital flow – across China, Japan, and South Korea. But media visibility doesn’t always equal technical leadership or defensible IP. The chart that follows spotlights the most active companies in this regional surge.

7.0 The Global IP Landscape — What Companies and Investors Must Understand

Startups often assume their technology is novel. Investors often assume the patents are strong. In humanoid robotics—where core system architectures are converging and legacy incumbents have been filing for decades—both assumptions are frequently wrong. This section provides a strategic preview of the global IP terrain that capital and operators alike must navigate. Drawing from over 11,000 patent families filed by 1,794 assignees across 41 jurisdictions, the data reveals a far more crowded – and structurally uneven – competitive landscape than market narratives suggest.

For company leadership and institutional capital, the implications are clear:

- You are not alone. Global OEMs, Asian robotics giants, and major research institutions have already claimed significant ground. Understanding who’s out there is essential to avoid collision and to identify potential collaborators.

- Claim scope rarely matches pitch scope. Startups often overestimate the breadth and relevance of their IP. Without alignment between what’s protectable and what’s commercially central, capital gets misallocated, and product strategy drifts.

- Your IP strategy must be intentional. As hardware converges around similar architectures, the differentiation will come from claim construction, jurisdictional reach, and full-stack system protection, not just from demos or velocity.

- IP is now a go-to-market asset. Portfolio strength must inform partnerships, licensing, and market entry. The most durable companies will treat IP as a strategic layer, not a legal trailing function.

Signals from the Global IP Landscape

The companies featured in this report – Figure, Sanctuary, Apptronik, Agility, and others – are at the center of investor attention. But they represent only a fraction of the global activity shaping humanoid robotics IP.

The broader landscape reveals a different picture—one dominated not by startups, but by legacy industrials, Asian conglomerates, and university R&D ecosystems. These actors have quietly built deep portfolios across core technical domains such as locomotion, balance, actuation, and manipulation. In many cases, they’ve already claimed the foundational layers newer entrants are now trying to productize.

Early signals include:

- 65%+ of foundational IP is held in Asia, concentrated in China, Japan, and South Korea.

- Honda, Sony, Toyota, Hyundai, and Samsung appear consistently among the top global assignees by patent family count.

- Top-tier academic institutions – including Tsinghua, AIST, Osaka University, and KAIST – hold significant IP in robot cognition, dexterity, and human-robot interaction.

- Only one VC-backed company – Sanctuary – appears in the top 20 global assignees, with filings spanning seven jurisdictions.

This raises a critical strategic question: Are the most visible companies building the future, or just building on ground already owned by others?

Methodology

How We Built the Global IP Landscape

To construct a decision-ready map of humanoid robotics IP, we leveraged PatentVest, our proprietary global patent intelligence platform. As of April 2025, PatentVest integrates over 195 million patent documents across 106 jurisdictions, including full-text, machine-translated filings in Chinese, Japanese, and Korean.

Search Strategy

We focused on broad, well-established terminology related to humanoid robotics to ensure comprehensive coverage of the global patent landscape. This approach was designed to surface not only full-system humanoid robots, but also the enabling technologies, such as movement, control, and interaction, that make them viable in real-world environments.

Dataset Construction

The initial search returned:

- Over 1 million robot-related documents (634,248 patent families) from 21,078 companies across 84 jurisdictions

- ~24,000 humanoid-specific documents (12,847 patent families) from 2,082 companies across 44 jurisdictions

We then applied a structured refinement process, filtering out approximately 2,777 documents (1,706 families from 288 companies) that lacked technical relevance, such as patents focused on fixed industrial automation or unrelated medical robotics.

Final dataset:

- 20,963 patent documents

- 11,141 patent families

- 1,794 unique assignees

- Across 41 jurisdictions

This refined set represents the most focused and globally inclusive snapshot of humanoid robotics innovation as of April 2025.

Expert Portfolio Analysis

Rather than relying solely on automated analytics, our team of domain experts reviewed and interpreted key patent portfolios. This qualitative layer enabled us to identify which organizations – startups, OEMs, and academic institutions – are making meaningful, strategically positioned investments in humanoid systems.

Assignee Classification

To clarify ownership dynamics, we segmented assignees by type:

- Corporate entities – including startups, OEMs, and multinational tech companies

- Academic and public institutions – including universities, research labs, and government-funded programs

This segmentation enables clearer insight into who controls commercially relevant IP versus who contributes foundational research, critical context for evaluating licensing risk, M&A signals, and strategic white space.

Top IP Holders In Humanoid Robotics

The table below lists the top global assignees by patent family count in humanoid robotics. It includes both commercial companies and public-sector institutions, highlighting the concentration of IP across legacy industrials, Asian electronics giants, and select research entities.

Top Filing Jurisdictions

Patent activity in humanoid robotics is highly concentrated in a few regions, particularly Asia. This jurisdictional spread highlights where companies are protecting core technologies and where enforcement or licensing leverage is most likely to emerge.

Together, China, Japan, and South Korea account for more than 65% of all patent families in humanoid robotics.

Leading Universities & Research Institutions

In addition to corporate assignees, academic institutions play a central role in foundational IP, particularly in control systems, dexterity, and human-robot interaction.

These institutions hold IP that frequently predates – and sometimes overlaps with – current startup innovation. Strategic partnerships, licensing opportunities, or risks often begin here.

Disclaimer:

All patent portfolio data and analysis in this report are based on publicly available information as of May 2025, sourced through PatentVest, our proprietary global patent database. While every effort has been made to ensure accuracy and completeness, the findings may not reflect unpublished, pending, or confidential filings. Companies may hold additional IP assets that are not yet publicly disclosed. This report should be considered a snapshot, not a definitive account, of current IP positions.