Authors: Joanna Sadowska, Will Rosellini, Oscar Chow, Lisette Chavez

1. Executive Summary

Cardiac stem cell therapy is not an emerging field. It is a space that has undergone a long period of setbacks, recalibration, and consolidation. After more than two decades of clinical trials, regulatory engagement, and investment, the field has yet to deliver an FDA-approved therapy. Many early programs failed to meet primary endpoints, and several companies have exited or shifted focus. What remains is a smaller group of companies pursuing more focused, technically sound strategies that reflect the lessons of the past.

The unmet need remains large. Heart failure affects more than 64 million people worldwide, and the total addressable market across major cardiac indications is projected to exceed 48 billion dollars by 2030. For patients with advanced or refractory disease, regenerative solutions still represent a potential leap beyond conventional pharmacologic care.

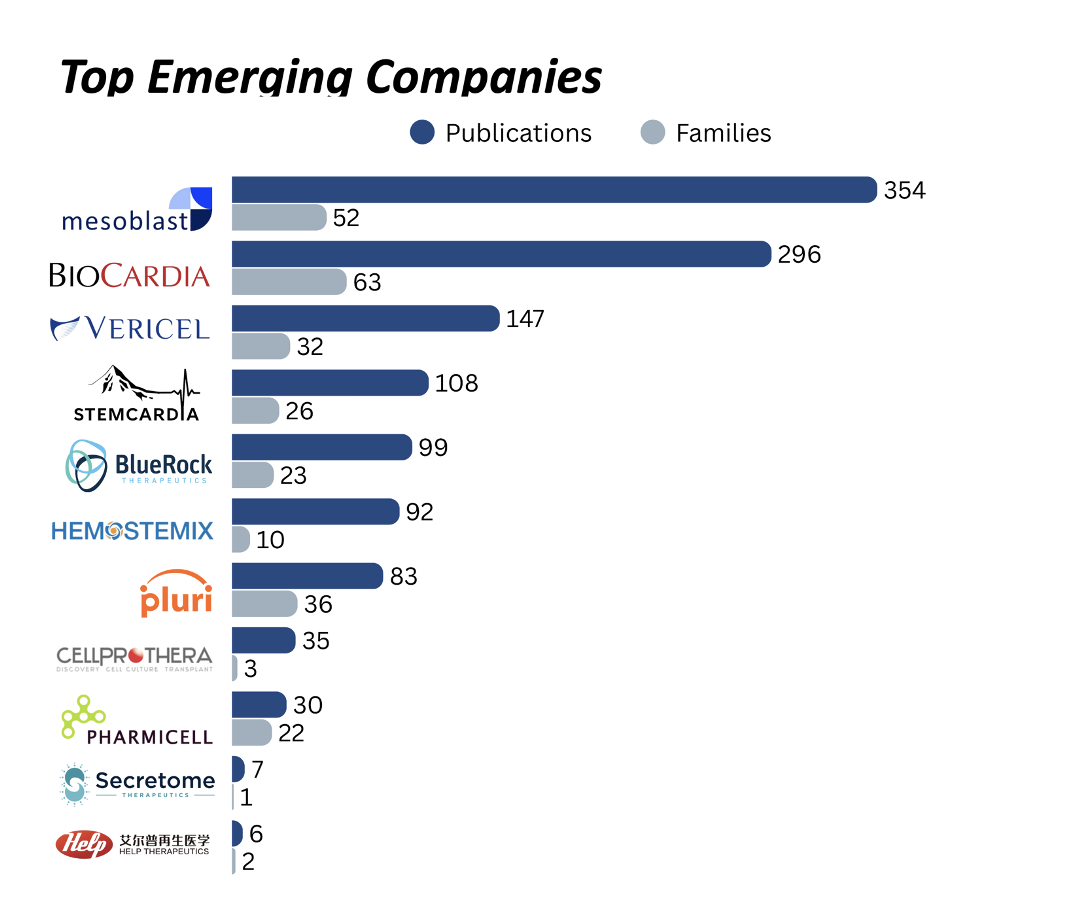

This report examines the field as it exists today – consolidated, more cautious, and defined by execution risk rather than scientific hype. We analyzed over 21,000 patent families related to cardiac stem cell therapy. We identified which companies are still running clinical programs, who owns the foundational IP, and where meaningful white space may still exist.

A limited group of companies remains active. Their approaches range from iPSC-derived cardiomyocytes and secretome therapies to autologous CD34⁺ constructs and engineered delivery platforms. While none have yet achieved commercial validation, each represents a distinct technical bet on how to make regenerative cardiology viable.

Companies currently active include:

- Mesoblast: Allogeneic MPC therapy with DREAM-HF Phase 3 data and over 354 patents across 52 families in cardiac indications

- BioCardia: Myocardial delivery via Helix catheter with autologous and allogeneic pipelines

- Secretome Therapeutics: Neonatal progenitor secretome in first-in-human HFpEF trial

- HELP Therapeutics: IND-cleared iPSC cardiomyocytes with automated GMP manufacturing

- Vericel: RMAT-designated autologous platform with preserved cardiac IP

- Pluri Inc.: Placental stromal cell therapies with scalable 3D bioreactor production

- StemCardia: Gene-edited cardiomyocyte therapies partnered with BioCardia

- BlueRock Therapeutics (Bayer): Preclinical iPSC-derived cardiomyocytes (BR-CM01)

- Hemostemix: Peripheral blood–derived autologous cell therapy

- CellProthera: GMP-expanded CD34+ therapy for post-MI cardiac repair

- Pharmicell: First approved cardiac stem cell therapy (KFDA), active in Asia

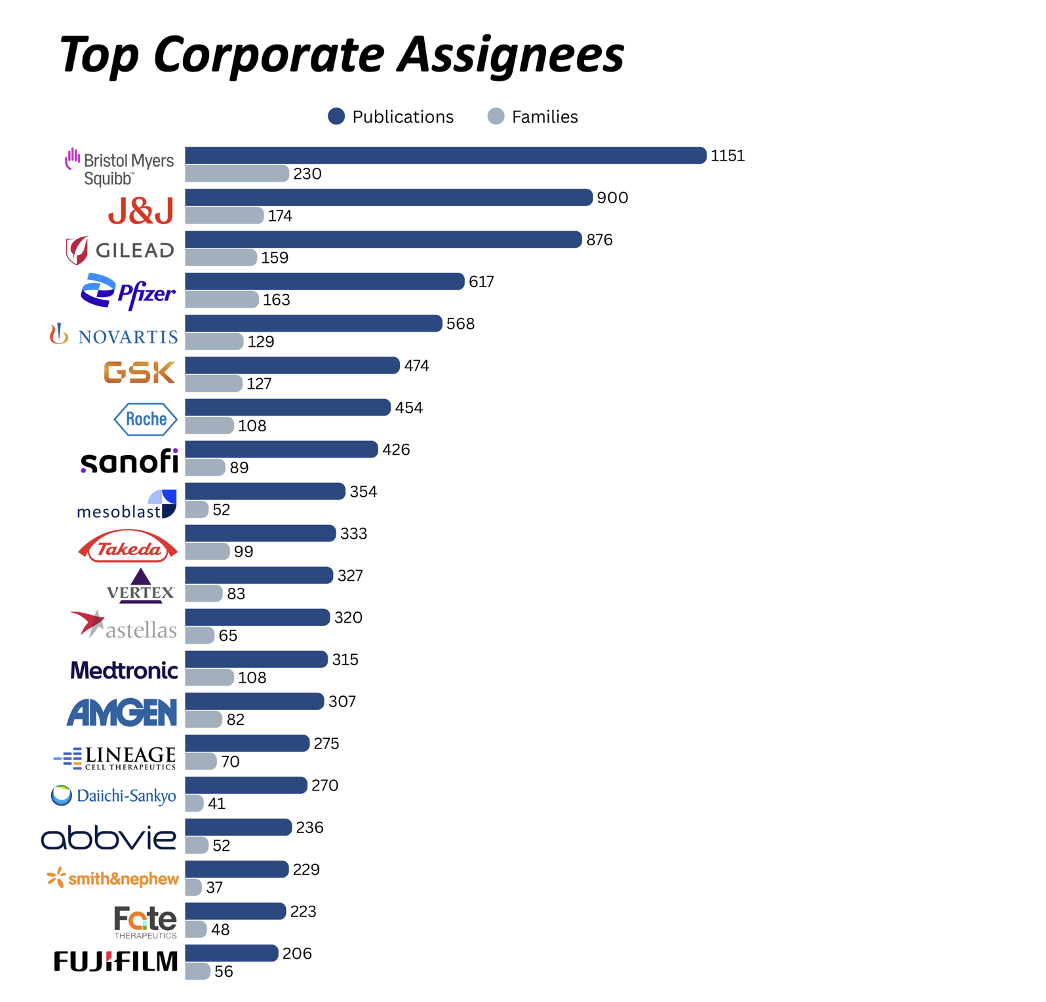

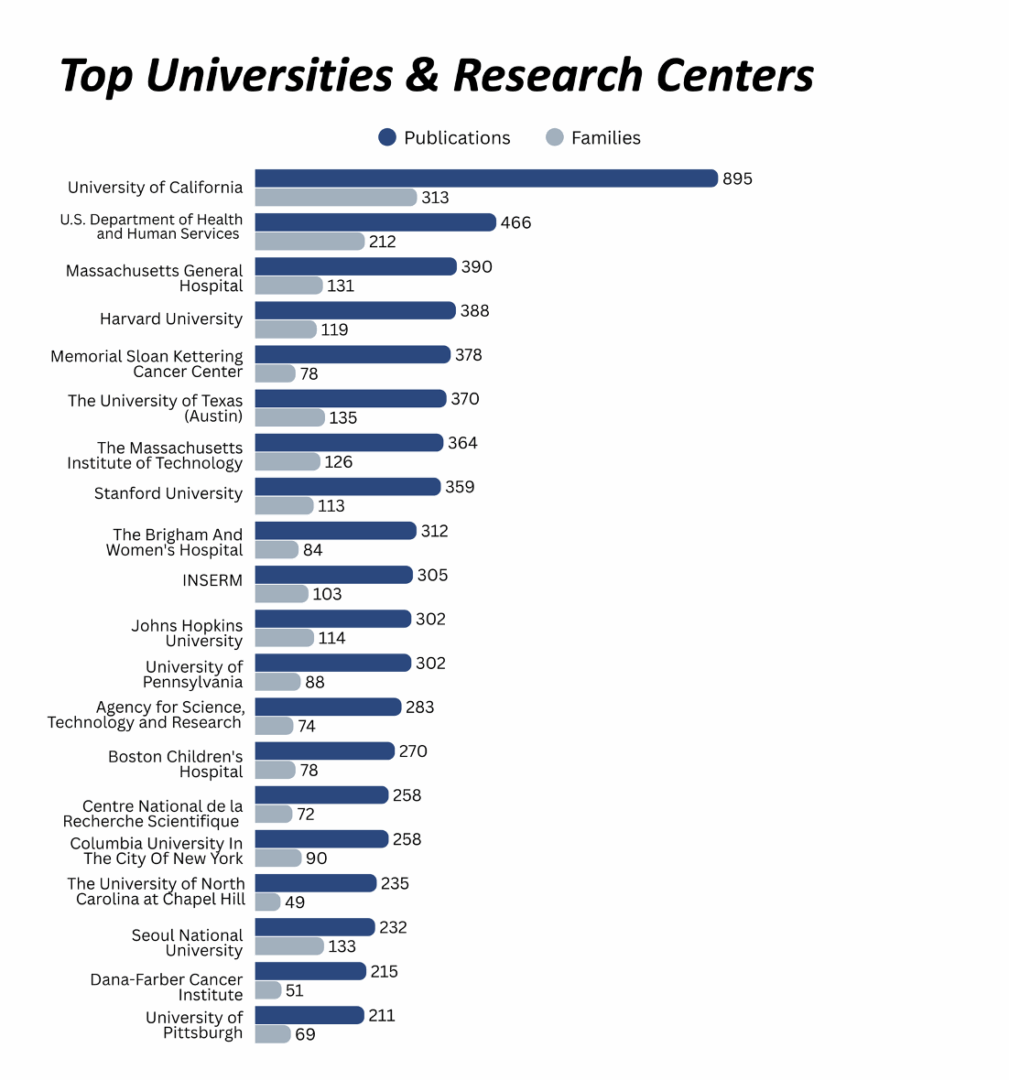

We also mapped the patent landscape to understand who controls the foundational IP across delivery systems, manufacturing, reprogramming, and composition. The field remains fragmented, with meaningful IP concentrated in both commercial and academic hands.

- Corporate IP leaders include: Bristol-Myers Squibb, Johnson & Johnson, Gilead Sciences, Pfizer, Novartis, GSK, Roche, Sanofi, Mesoblast, Takeda, Vertex Pharmaceuticals, Astellas Pharma, Medtronic, Amgen, Lineage Cell Therapeutics, Daiichi Sankyo, AbbVie, Smith & Nephew, Fate Therapeutics, Fujifilm

- Foundational academic assignees include: University of California, U.S. Department of Health and Human Services, Massachusetts General Hospital, Harvard University, Memorial Sloan Kettering Cancer Center, University of Texas at Austin, MIT, Stanford University, Brigham and Women’s Hospital, INSERM, Johns Hopkins University, University of Pennsylvania, A*STAR, Boston Children’s Hospital, CNRS, Columbia University, University of North Carolina at Chapel Hill, Seoul National University, Dana-Farber Cancer Institute, University of Pittsburgh

This report offers a realistic view of the space as it stands today. The science has matured. The strategies are more refined. But the bar for success remains high, and any path forward will depend on defensible IP, clinical validation, and scalable platforms that can meet both regulatory and commercial demands.

2. Collapse, Contraction, and Reinvention

Cardiac stem cell therapy began with a bold premise: that damaged heart tissue could be regenerated using cell-based interventions. Over two decades and more than fifty clinical trials later, the field has failed to deliver a single FDA-approved therapy. Most programs relied on surrogate endpoints, were underpowered, and showed little to no consistent clinical benefit.

As high-profile trials failed, investor confidence declined and companies began to pivot or exit the space entirely. What followed was a cycle of retraction, rethinking, and redirection.

2.1 Companies That Pivoted

Several companies with well-funded cardiac cell therapy programs redirected their focus after failing to demonstrate clinical efficacy or identify a viable regulatory path.

These pivots were strategic exits. In each case, the decision reflected a broken therapeutic hypothesis or a shift toward less risky, more commercially viable applications.

2.2 Programs That Were Abandoned

Some cardiac stem cell efforts were not redirected—they were shut down entirely. Many failed due to safety concerns, trial futility, regulatory scrutiny, or commercial irrelevance.

These outcomes shaped how regulators view the field. They also help explain why remaining programs are more cautious, narrow in scope, and focused on endpoints that align with modern FDA expectations.

2.3 What Remains

Today, the field looks very different. A smaller set of companies is pursuing more targeted strategies. The focus has shifted from full regeneration to incremental improvement, often through paracrine signaling, immune modulation, or engineered delivery.

Platforms now rely on iPSCs, neonatal progenitor cells, CD34+ constructs, or secretome-based interventions. Manufacturing processes have become more automated and standardized. Trial designs emphasize functional improvement over imaging endpoints.

These are all steps forward, but none offer resolution. The field still lacks definitive clinical proof. No platform has yet demonstrated consistent efficacy with a clear path to regulatory approval and commercial adoption.

The companies that remain are operating in the shadow of the failures that came before them. They are not building on success. They are working to prove that this space deserves a second chance

3. Cardiovascular Disease: Market Context and Strategic Rationale

Cardiovascular disease remains the leading cause of death globally. Annual mortality is projected to exceed 23 million by 2030, driven by aging populations and the increasing prevalence of chronic non-communicable diseases. The economic burden is substantial. In the United States, the American Heart Association estimated total costs related to cardiovascular disease at over 400 billion dollars in 2018, including both direct healthcare expenses and indirect losses from disability and reduced productivity.

Standard treatments such as statins, beta-blockers, and ACE inhibitors address disease progression but do not reverse underlying tissue damage. In advanced cases, particularly heart failure, myocardial infarction, and cardiomyopathies, therapeutic options are limited. Heart transplantation remains the only curative solution for end-stage disease, but it is constrained by donor availability and patient eligibility.

This therapeutic gap continues to attract interest in regenerative approaches. The rationale for cardiac stem cell therapy is based on the potential to repair or restore damaged myocardium, providing functional benefit in conditions where current interventions are palliative or non-curative. From a commercial perspective, the scale of the opportunity is significant. Global market projections for heart failure therapies alone exceed 48 billion dollars by 2030.

Stem cell therapies are viewed as a potential platform category that could apply across multiple high-burden indications. However, the failure of earlier programs has reset expectations. Investors are more focused on clinical validation, scalability, and regulatory feasibility. Payers are increasingly concerned with cost-effectiveness and risk-sharing mechanisms. Scientific enthusiasm has shifted toward defined mechanisms of action such as paracrine signaling, immune modulation, or targeted delivery.

This report evaluates cardiac stem cell therapies in light of these pressures. The clinical opportunity remains large. The barrier to execution is higher. The field is no longer defined by innovation alone. It is shaped by what can be validated, scaled, and protected.

4. Market Opportunity and Sizing

The total addressable market for cardiac stem cell therapies is shaped by a set of chronic, high-burden conditions that remain difficult to treat with conventional interventions. These include heart failure, myocardial infarction, dilated cardiomyopathy, and hypertrophic cardiomyopathy. Each represents a substantial unmet need and a potential target for regenerative approaches.

Together, these indications represent a combined addressable market of approximately $10.5 billion today, with forecasts exceeding $24 billion by the mid-2030s. This projected growth continues to attract investment and innovation, despite the technical and clinical challenges that have limited past progress.

While market size remains compelling, commercial viability for cardiac stem cell therapies will depend on whether these approaches can deliver outcomes that justify pricing, scale reliably across diverse patient populations, and compete against established pharmacologic therapies.

5. Execution Challenges in Cardiac Cell Therapy

Despite two decades of investment and more than fifty clinical trials, no cardiac stem cell therapy has achieved FDA approval. Technical complexity, inconsistent results, and evolving regulatory expectations have limited progress. The field continues to face six core bottlenecks across both preclinical and postclinical domains.

Preclinical and Translational Barriers

- Scientific: Cell survival, engraftment, and functional integration remain inconsistent. Once delivered into damaged tissue, stem cells display variable behavior, making it difficult to predict therapeutic dose or mechanism. Existing animal models do not fully replicate human cardiac physiology or immune response, which limits their predictive value for clinical translation.

- Manufacturing: Transitioning from laboratory-scale production to GMP-grade manufacturing introduces significant variability. Key challenges include maintaining cell viability, purity, and potency across batches. Processes can require up to 14 days, with large-scale production demands ranging from hundreds of millions to billions of cells per patient. Cryopreservation, transport, and post-thaw testing add further complexity. Estimated costs per clinical-grade batch can exceed 200,000 dollars.

- Clinical Trial Design: Many early trials were underpowered, using small sample sizes that were insufficient to detect statistically meaningful outcomes. This limited the ability to demonstrate efficacy or draw conclusions about safety. More recent programs have adopted multicenter designs with larger patient populations, such as DREAM-HF (565 patients), but challenges remain. Trials are long, expensive, and high risk.

Postclinical and Commercial Barriers

- Regulatory: Cardiac cell therapies are subject to biologics regulation. In the United States, they require both Investigational New Drug (IND) clearance and a Biologics License Application (BLA) to achieve approval. Programs may be eligible for Regenerative Medicine Advanced Therapy (RMAT) designation if they show early signs of efficacy in serious conditions. In Europe, these therapies are regulated under the Advanced Therapy Medicinal Products (ATMP) framework. Global regulatory harmonization remains limited, adding complexity for multi-jurisdictional development.

- Commercial Viability: Even if technically feasible, cardiac stem cell therapies face difficult questions around cost and reimbursement. Treatment costs typically range from 100,000 to 200,000 dollars per patient. Payers are still developing frameworks for one-time, high-cost interventions. Outcomes-based agreements, installment models, and risk-sharing structures are being explored, but adoption is slow and variable by region.

- Patentability: Intellectual property remains a critical barrier. U.S. court decisions such as Mayo, Myriad, and Alice have narrowed the scope of patent eligibility for cell-based innovations. Unmodified cells or naturally occurring phenomena are difficult to protect. As a result, companies must focus on filing claims related to engineered delivery systems, reprogramming methods, and scalable manufacturing processes.

These challenges shape not only what can be developed, but what can be defended. Programs that cannot solve for both technical feasibility and strategic protection will face difficulty advancing beyond the trial stage.

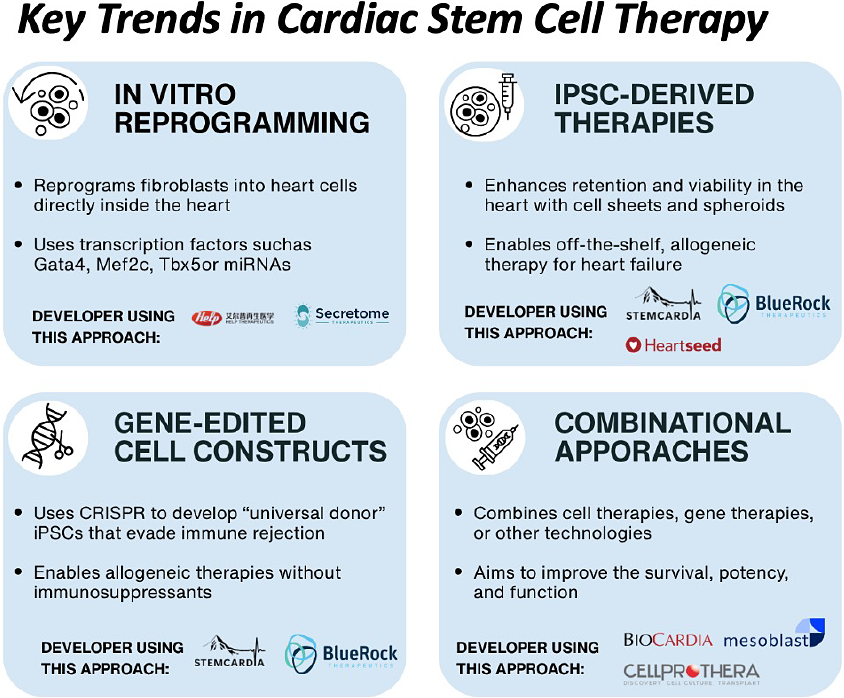

6. Platform Strategies and Technology Approaches

Cardiac stem cell therapy is no longer framed around broad claims of regeneration. The field has shifted toward more defined biological mechanisms, targeted delivery strategies, and platforms that can be standardized, scaled, and protected.

The approaches currently in development reflect this transition. Each represents a distinct hypothesis about how to improve functional recovery, avoid immune rejection, and deliver durable therapeutic benefit. While early clinical activity is increasing, most programs remain exploratory and unproven.

- In Vivo Reprogramming: This strategy aims to convert existing cardiac cells into functional cardiomyocytes without transplantation. Tenaya Therapeutics is using an adeno-associated virus (AAV) vector to deliver a defined set of cardiogenic genes directly to heart tissue. The platform is designed to reprogram resident cardiac fibroblasts in situ. Preclinical data have been published, and clinical development is planned.

- iPSC-Derived Cardiomyocytes: One of the most widely pursued strategies involves producing cardiomyocytes from induced pluripotent stem cells (iPSCs) for use as an allogeneic cell therapy. Heartseed Inc. has developed HS-001, formulated as spheroids to enhance retention and viability. A Phase 1/2 trial in Japan is underway. Similarly, HELP Therapeutics is developing HiCM-188, a purified iPSC-derived cardiomyocyte product cleared for clinical testing in China. Initial outcomes have shown good tolerability and modest improvements in cardiac function.

- Gene-Edited Constructs: Several groups are applying gene editing to enhance cell compatibility and reduce immune rejection. Sana Biotechnology is working on hypoimmune iPSC-derived cardiomyocytes based on preclinical research from UCSF. Long-term engraftment has been observed in primate models without immunosuppression. While human trials have not yet begun, this platform represents a potentially scalable approach to off-the-shelf cardiac cell therapy.

- Scaffold-Enabled and Combinational Therapies: Some developers are pairing cells with biomaterials to improve retention, structural integration, and functional recovery. These include engineered heart muscle patches composed of iPSC-derived cardiomyocytes embedded in collagen hydrogel scaffolds. University Medical Center Göttingen and Osaka University have led clinical-stage development. Cuorips, a company spun out of Osaka, completed a Phase 1/2 trial in ischemic cardiomyopathy and has filed for market approval in Japan.

Each of these strategies reflects a step away from generalized cell therapy and toward platform-specific approaches that prioritize mechanism, manufacturability, and IP control. Rather than treating the cell as the product, developers are increasingly building around integrated systems that combine therapeutic function, delivery optimization, and regulatory viability.

These modalities are not interchangeable. Their success will depend on clinical outcomes, but also on the ability to manufacture consistently, deliver effectively, and secure protection through differentiated claims. Most remain in early development. None have demonstrated superiority. All are still hypotheses under evaluation.

7. Company Profiles: Active Developers in Cardiac Cell Therapy

This section profiles a select group of companies that continue to develop cardiac-focused cell therapies. Each has pursued a differentiated platform strategy based on delivery method, cell type, manufacturing model, or mechanism of action.

While the field has contracted significantly in recent years, these companies reflect the efforts to refine, reposition, and revalidate the therapeutic potential of cardiac cell therapy. Their programs span early to late-stage clinical development and include both autologous and allogeneic approaches, as well as iPSC-derived constructs, secretomes, and stromal cells.

Inclusion is based on:

- Active or recently completed trials targeting cardiac indications

- Use of stem cell–derived or cell-based products (excluding pure gene therapy)

- Evidence of platform innovation tied to cardiac regeneration, functional recovery, or immune modulation

This landscape reflects a more focused phase in the field. These companies are advancing technical and clinical hypotheses with greater clarity, and with increasing attention to scalability, regulatory alignment, and IP defensibility.

Mesoblast Ltd.

Mesoblast is a global leader in allogeneic mesenchymal precursor cell (MPC) therapy and has advanced one of the most clinically mature cardiac cell programs. Its product rexlemestrocel-L (Revascor) comprises allogeneic bone marrow-derived MPCs (a proprietary mesenchymal stromal cell population) for heart failure with reduced ejection fraction (HFrEF). The flagship Mesoblast program, DREAM-HF (Phase 3; NCT02032004), in ischemic heart failure (537 patients) used a single transendocardial injection of MPCs. The trial did not meet its primary endpoint; benefit was confined to a pre-specified inflammatory-high subgroup.

Mesoblast has secured FDA RMAT and orphan designations for rexlemestrocel-L in advanced ischemic heart failure and is pursuing an accelerated approval path focusing on patients with end-stage or inflammatory heart failure. Mesoblast also tested MPC therapy in end-stage patients with left ventricular assist devices, demonstrating reduced complications (e.g. a 76% drop in LVAD-related gastrointestinal bleeding), but the trials missed the primary weaning endpoint. Mesoblast possesses a broad patent estate around mesenchymal lineage cells and manufacturing.

Mesoblast’s IP estate related to cardiac stem cells spans 52 patent families and over 354 patent documents globally, with claims covering MPC composition, surface marker characterization, and manufacturing scalability. Key jurisdictions include the U.S., EU, Japan, China, and Australia, and the portfolio continues to be maintained with recent filings through 2022. The company has raised over $500 million and is publicly listed on the ASX (MSB) with a market cap of ~$2.2B. Key strategic investors include BlackRock, Morgan Stanley, Susquehanna, Oaktree, and Goldman Sachs. Past M&A includes its acquisition of Angioblast Systems. With RMAT status and a well-characterized cell platform, Mesoblast is well-positioned to be one of the first companies to commercialize a regenerative cardiac stem cell therapy.

BioCardia Inc.

BioCardia is a U.S. company at the intersection of therapeutic devices and cell therapy, known for its Helix transendocardial delivery catheter and CardiAMP cell therapy programs. BioCardia’s CardiAMP is an autologous bone marrow–derived mononuclear cell therapy for ischemic heart failure (HFrEF) that is paired with a patient selection diagnostic. In the completed Phase 3 CardiAMP-HF trial (115 patients), a single injection of CardiAMP cells into the myocardium (using the Helix catheter) did not meet the primary efficacy endpoint overall, but it demonstrated promising benefits in a large high-risk subset. In addition to autologous therapy, BioCardia is developing an allogeneic MSC product (CardiALLO) for patients ineligible for CardiAMP, and exploring cell-derived exosome therapies.

BioCardia’s platform features the proprietary Helix catheter, which enables minimally invasive, targeted intramyocardial cell delivery – a tool that has been employed not only in BioCardia’s trials but also via partnerships (e.g. with CellProthera and StemCardia) to deliver other companies’ cells.

The company’s IP portfolio spans 63 patent families and 269 patent documents globally, covering catheter-based delivery, autologous potency screening, and various vascular access systems. Key jurisdictions include the U.S., Europe, Japan, and Australia. BioCardia is publicly traded (NASDAQ: BCDA) with a current market cap of ~$10M. Key institutional investors include CM Management, Susquehanna International, Geode Capital, Brown Advisory, Vanguard, UBS, and Morgan Stanley. Despite completing a $7.2M public offering in 2024, the company reported only ~$2M in cash as of Q1 2025 – providing runway only through mid-year.

Vericel Corporation

Vericel (formerly Aastrom Biosciences) advanced an autologous expanded bone marrow cell therapy, ixmyelocel-T, for advanced ischemic heart failure (dilated cardiomyopathy). Ixmyelocel-T is a patient-specific multicellular product enriched for mesenchymal stromal cells and M2 macrophages, produced via a proprietary closed bioreactor system.

In a Phase 2b trial (ixCELL-DCM) in patients with severe heart failure, a single transendocardial injection of ixmyelocel-T achieved a 37% reduction in cardiac-related hospitalizations, deaths, or acute episodes compared to placebo over 12 months leading to to FDA orphan, Fast Track, and Regenerative Medicine Advanced Therapy (RMAT) designations. Although Vericel has since paused further cardiac trials to prioritize its commercial cell therapy products in cartilage repair and skin regeneration, it retains the rights to ixmyelocel-T for potential future development or licensing.

The company is financially stable with a market cap of $2.06B and over $157M in funding, and maintains partnerships such as the exclusive licensing of ixmyelocel-T to ICT for development in Greater China and Southeast Asia. Vericel’s intellectual property includes automated systems for expanding reparative cells and a portfolio of 32 patent families and 147 documents (filed between 1996–2025), covering cell therapy compositions, regenerative medicine, and tissue repair, with active protection in US, EU, Canada, Japan, and Australia. Major institutional investors include BlackRock, Inc., Vanguard Group Inc., and Brown Capital Management LLC.

StemCardia

StemCardia is a newer entrant (Los Angeles–based) focused on “remuscularizing” the failing heart with true cardiac muscle cells. The company is advancing a pipeline of four preclinical candidates: two ex vivo iPSC-derived cardiomyocyte therapies (SCM-101 for chronic heart failure and SCM-102 for ventricular fibrillation) and two in vivo gene therapy programs (RNR and KDM4D), aimed at boosting cardiomyocyte function via metabolic and epigenetic modulation. StemCardia’s approach centers on true cardiomyocyte replacement rather than paracrine effects, aiming to remuscularize the failing heart.

The company has formed a long-term partnership with BioCardia to use its Helix catheter system for intramyocardial delivery of the cell therapy product, and has licensed over 60 patents from the University of Washington. StemCardia’s intellectual property includes 26 patent families and 108 documents across key jurisdictions (US, EU, JP, CA, CN), with broad claims covering methods to enhance cardiac function through modified cardiomyocytes or viral vectors. The most recent filings were in 2025, indicating an actively maintained and expanding IP portfolio in next-generation cardiac cell and gene therapy.

BlueRock Therapeutics

BlueRock Therapeutics is developing a next-generation platform that harnesses induced pluripotent stem cells (iPSCs) to regenerate cardiac muscle lost to myocardial infarction and chronic heart failure. Its lead program, BR-CM01, aims to restore cardiac function by delivering healthy cardiomyocytes into damaged myocardium. The lead candidate BR-CM01 is in preclinical development and aims to transplant healthy iPSC-derived cardiomyocytes to restore cardiac function after major infarcts. The platform leverages licensed iPSC manufacturing technology from Ncardia and partnerships with Editas Medicine and Senti Biosciences to enhance cell performance and safety via gene circuits and editing.

The company was f acquired by Bayer in 2019 for up to $1 billion, signaling strong validation. Prior to the acquisition, BlueRock raised $225 million in Series A funding, backed by Versant Ventures and Leaps by Bayer. It has since operated as a wholly owned subsidiary, giving Bayer full access to BlueRock’s cell and gene platform for regenerative medicine. Its IP portfolio includes 99 patent documents across 23 families filed in 11 jurisdictions covering innovative delivery devices and methods for generating iPSCs.

Hemostemix Inc.

Founded in 2003, Hemostemix Inc. is developing a platform of autologous stem cell therapies for the treatment of cardiovascular diseases. The company’s lead product, ACP-01 (Angiogenic Cell Precursors), is in development for ischemic and dilated cardiomyopathy, congestive heart failure, chronic limb-threatening ischemia (CLTI), angina, and vascular dementia. ACP-01 is manufactured from a simple peripheral blood draw using a fully autologous, serum-based expansion protocol completed in seven days. Hemostemix has completed seven clinical studies involving 318 patients, with results published in nine peer-reviewed journals. A Phase II trial in CLTI demonstrated significant improvements in tissue perfusion, pain reduction, wound healing, and limb salvage, with long-term follow-up showing 0% mortality and 83% wound healing in no-option patients followed for up to 4.5 years. In a retrospective cardiac study, ACP-01 increased LVEF by 24–47% over 12 months, including an improvement from 14.6% to 28.4% in the most severe heart failure cases. In addition to ACP-01, Hemostemix is developing NCP-01 (Neuronal Cell Precursors) and CCP-01 (Cardiomyocyte Cell Precursors).

Hemostemix’s IP portfolio consists of 10 patent families and 92 publications, with filings across 18 jurisdictions, including the United States, Canada, Europe, and Asia. The portfolio includes claims covering proprietary methods of cell preparation, the composition of progenitor cell products, and their therapeutic use across cardiovascular, neurological, and retinal indications. It also protects Hemostemix’s automated manufacturing system, designed to enable scalable production of autologous therapies under GMP conditions.

Pluri Inc. (Pluristem Therapeutics)

Pluri Inc., formerly Pluristem Therapeutics, is an Israeli company known for its placental-derived stem cell platform. It cultures mesenchymal-like adherent stromal cells (branded PLX cells) from placental tissue in a 3D bioreactor system, enabling mass production of “off-the-shelf” allogeneic cells. The pre-clinical studies revealed that intravenous infusion of PLX cells in diabetic mouse models of diastolic heart failure significantly improved diastolic function, reducing myocardial stiffness and inflammation while enhancing vascularization.

Pluri’s PLX cells are “off-the-shelf” allogeneic therapies, with regenerative and immunomodulatory mechanisms that respond to tissue stress by releasing paracrine factors. Their lead programs (PLX-PAD for ischemic muscle injury and PLX-R18 for hematologic recovery) are in Phase I/II clinical development, with the company exploring cardiovascular extensions of these indications.

Pluri operates with a market cap of ~$35M (NASDAQ: PLUR) and has raised $172.5M across 12 funding rounds. In addition to public sector support from the European Investment Bank, Israel Innovation Authority, and NASA, institutional backers include Renaissance Technologies, Values First Advisors, Jane Street, Eversource, JPMorgan, UBS, and Morgan Stanley. Its IP portfolio includes 36 families and 83 documents, filed in jurisdictions including the US, EU, JP, KR, CN, and IL. Core patents focus on placenta-derived stromal cell expansion, adherent cell-based therapies, and indications such as ischemia and inflammation. Claims are generally broad, though narrowed in some cases due to population-specific definitions (e.g., CD34-negative cell populations). Active filings extend through 2025, and IP is being actively maintained.

CellProthera

CellProthera is a French regenerative medicine company developing an autologous stem cell therapy called ProtheraCytes® for cardiac repair after myocardial infarction. ProtheraCytes are the patient’s own CD34⁺ hematopoietic stem cells, collected (via mobilization and apheresis) and expanded ex vivo to high doses using a proprietary GMP automation process.

In the Phase I/IIb EXCELLENT trial, high-risk post-MI patients with depressed ejection fraction had significantly improved myocardial viability in previously akinetic regions at 6 months. These outcomes suggest that ProtheraCytes therapy can promote revascularization and regeneration of infarcted tissue, potentially preventing progression to heart failure.

CellProthera has raised $9.58M in funding, supported by early and institutional investors including Horizon 2020, Bpifrance, Alsace Business Angels, and SEMIA Incubateur d’Alsace. The company also maintains a strategic partnership with BioCardia. Its IP portfolio includes 3 families and 35 documents, covering automated cell culture technologies and therapeutic use in AMI across jurisdictions such as FR, US, CN, EP, and JP. Claims are broad, and recent filings suggest continued IP maintenance.

Secretome Therapeutics

Secretome Therapeutics is a U.S. biotech focusing on the paracrine factors of stem cells as a therapy for heart disease. Its lead clinical product, STM-01, is an allogeneic neonatal cardiac progenitor cell (nCPC) therapy formulated to treat heart failure via potent secretome release. STM-01 is being tested in heart failure with preserved ejection fraction (HFpEF) – a population with high unmet need and no prior cell therapy trials. In early 2025, Secretome Therapeutics dosed the first patient in a Phase 1 HFpEF trial, making STM-01 the first off-the-shelf stem cell therapy evaluated in HfpEF. The company has secured patents on its progenitor cell manufacturing and secretome composition.

Secretome secured $20.4M in late 2024, supporting a projected runway through 2026. Its IP portfolio includes 1 family and 7 patent documents, focused on immortalized neonatal cardiac stem cells and their secretomes, filed in AU, CA, EP, US, and WO jurisdictions. It is backed by Huffines Enterprises Science & Technology Investments, TEDCO, the University System of Maryland Momentum Fund, and UM Ventures.

Pharmicell Co. Ltd.

Pharmicell developed the world’s first approved cardiac stem cell therapy in 2011 with Hearticellgram-AMI, an autologous bone marrow–derived mesenchymal stem cell (MSC) treatment for acute myocardial infarction. In Korean trials, a one-time intracoronary infusion of Hearticellgram-AMI showed modest but measurable benefits (≈6% absolute ejection fraction improvement at 6 months post-MI) and the product recived Korean FDA approval after Phase II studies.

Its IP portfolio includes 22 families and 30 documents, with filings in KR, CN, US, and WO jurisdictions. Notably, Pharmicell holds patents on methods for differentiating MSCs into cardiogenic cells using PTK inhibitors. The company is publicly listed with a valuation of approximately $485M and is backed by KDB Capital, Shinhan Venture Investment, and Neoplux. Its continued patent activity and investor support underscore its long-term commitment to leadership in regenerative cardiology.

HELP Therapeutics Co. Ltd.

HELP Therapeutics is a China-based biotech (founded 2016) pioneering induced pluripotent stem cell (iPSC) technology for cardiac repair. Its flagship program HiCM-188 consists of allogeneic human iPSC-derived cardiomyocytes formulated as an off-the-shelf “universal” cell therapy for end-stage heart failure. HELP achieved FDA IND clearance in 2024 to start a U.S. Phase I trial delivering HiCM-188 via intramyocardial injections during coronary bypass surgery. The Phase I will evaluate safety and dose in severe heart failure patients, with leading cardiology centers such as Texas Heart Institute. HELP has also developed an automated GMP manufacturing platform (“Help Cell-foundry”) and maintains an iPSC bank, positioning it with substantial IP in efficient iPSC production and differentiation.

Its IP portfolio includes 2 families and 6 patents, with active filings in the U.S., EU, China, Korea, and Japan, covering fully automated cell manufacturing systems. The company is backed by Bison Capital Financial Holdings, Jolmo Investment, Ming Bioventures, Share Capital, and DPH Capital.

Conclusion: Competitive Landscape

The current competitive landscape in cardiac stem cell therapy reflects a field that has become more focused following a period of contraction. After a wave of exits, clinical failures, and strategic pivots, a smaller group of companies continues to pursue targeted approaches in cardiovascular regeneration.

These companies are advancing distinct platform strategies that prioritize scalability, regulatory alignment, and biological clarity. Many are now focused on paracrine signaling, immune modulation, or iPSC-derived constructs. Delivery systems have improved, and manufacturing processes are more standardized. Clinical development has also shifted, with trials increasingly centered on functional endpoints such as NT-proBNP, ejection fraction, and hospitalization rates.

The diversity of technical approaches highlights the ongoing uncertainty around which modality, if any, will deliver the first commercially viable solution. Some companies have invested in proprietary delivery devices or automated GMP systems. Others are optimizing cell sourcing and formulation for off-the-shelf use or improved patient compatibility.

While none of the profiled companies have achieved regulatory approval, each represents a meaningful effort to define the next phase of cardiac cell therapy. Their platforms reflect different assumptions about what matters most—delivery precision, cell phenotype, immune response, or manufacturing control.

The outcomes of these programs will determine whether cardiac stem cell therapy can move beyond its early failures and establish a role in the treatment of structural heart disease.

8. Patent Landscape and Strategic IP Positions

Introduction

To understand who controls the most strategically relevant IP in cardiac stem cell therapy, we conducted a layered global search using PatentVest, our proprietary patent intelligence platform. As of May 2025, PatentVest integrates over 195 million patent records across 106 jurisdictions.

Our search was structured to filter for inventions intersecting stem cell biology, cardiac applications, and therapeutic relevance. The results were clustered into four major categories:

- Therapeutic Methods

- Biomaterials and Delivery Systems

- Genetic Engineering Approaches

- Exosome-Based Therapies

Patent filings accelerated significantly after 2016, driven by advances in iPSC reprogramming, CRISPR-based gene editing, and automated cell manufacturing.

This section highlights top corporate IP holders. Some are directly involved in cardiac stem cell development. Others hold enabling IP in cell therapy platforms that could be applied to cardiac applications in the future. These profiles reflect the strategic IP posture of key players rather than a ranking of clinical activity.

8.1 Corporate IP Activity

IP ownership in this space is distributed across a mix of large pharmaceutical firms and clinical-stage biotechs. The companies below rank highly in patent filings related to cardiac or stem cell technologies. While some hold direct clinical programs, others participate through platform technologies or strategic investments.

Bristol-Myers Squibb (BMS)

Bristol-Myers Squibb does not have a publicly disclosed in-house cardiac cell-therapy product. Its Celgene acquisition originally suggested potential access to Mesoblast’s allogeneic mesenchymal precursor cell (MPC) therapy (rexlemestrocel-L, trademark Revascor) for heart failure. However, Celgene’s right-of-first-refusal on the Mesoblast program lapsed in 2016, and BMS does not currently hold any rights or commercial interest in the therapy. Beyond Mesoblast, BMS maintains internal cardiovascular R&D (e.g., small molecules for heart failure) but has no other publicly known cardiac stem-cell initiatives. The flagship Mesoblast program, DREAM-HF (Phase 3; NCT02032004), in ischemic heart failure (537 patients) used a single transendocardial injection of MPCs (Revascor) and showed reductions in cardiovascular mortality and major adverse cardiac events (MACE) in high-risk patients.

Johnson & Johnson (J&J)

Johnson & Johnson (J&J), through its Janssen division, was historically active in cardiac stem-cell therapy and holds one of the largest patent portfolios in stem-cell biology. J&J partnered with Capricor Therapeutics in 2014 to develop CAP-1002, an allogeneic cardiosphere-derived cell therapy for cardiovascular indications. However, following disappointing clinical results in cardiac indications, Janssen terminated its option for CAP-1002 in 2017 and has not re-entered the cardiac stem-cell therapy field since.

J&J has accumulated extensive intellectual property in pluripotent stem-cell differentiation, which could potentially be leveraged for future cardiac applications. The company has also invested in regenerative-medicine partnerships beyond stem cells, including with ViaCyte (diabetes) and HeartFlow (non-cell cardiology technology), reflecting a continued broad interest in innovative cardiovascular therapies.

Gilead Sciences

As of 2025, Gilead does not have a dedicated cardiac stem-cell therapy in clinical trials. Its high ranking in this space reflects investments in enabling cell technologies and IP. Through its Kite Pharma subsidiary (focused on cell therapy), Gilead has funded startups working on induced pluripotent stem cell (iPSC) platforms. Kite was an early investor in Shoreline Biosciences, an allogeneic iPSC-derived cell-therapy company.

Although Gilead hasn’t made deals specifically for cardiac stem cells, it has shown interest in regenerative-medicine startups via partnerships with academic consortia and CIRM (California’s stem-cell agency). Gilead’s role in cardiac stem-cell therapy is emerging and platform-oriented: it holds key iPSC technology investments and patents, positioning it to participate if allogeneic cardiac cell therapies become viable—even though it currently has no cardiac cell product on the market or in trials.

Pfizer

Pfizer previously supported cardiac regenerative medicine through a dedicated Regenerative Medicine research group co-located in Cambridge, MA and Cambridge, UK. This unit was discontinued in 2015, though the company has maintained strategic partnerships and exploratory investments. In parallel, Pfizer has leveraged stem cells as research tools – using animal and adult stem cell models in its laboratories for over a decade to screen drug candidates and predict safety, including assays with cardiomyocytes to assess cardiac effects.

Pfizer’s pursuit of cardiac stem-cell therapies included collaborative clinical initiatives and strategic investments. This includes, in the past, a $111 million deal with Athersys, Inc. to license its MultiStem platform—an allogeneic adult stem cell therapy—which, at the time, was in early-stage trials for myocardial infarction (acute heart attacks).

Today, the company’s cardiovascular portfolio remains centered on traditional pharmacotherapies, and to date, Pfizer has not commercialized a cardiac stem-cell therapy.

Novartis

Novartis’ involvement in cardiac stem-cell therapy spans in-house research platforms, external partnerships, and support for clinical programs. One key internal innovation is its mini-heart platform, which enables scientists to model heart failure and other conditions in vitro. These stem-cell-derived cardiac organoids are used to identify new therapeutic targets and evaluate potential cardiac repair mechanisms in preclinical studies.

Novartis has also engaged in cardiac regenerative medicine through sponsored research and clinical trial support. For example, in the CHART-1 trial—a Phase III study of a stem-cell therapy (autologous cardiopoietic cells) for ischemic heart failure—trial investigators disclosed grant support from Novartis.

Similarly to Pfizer, Novartis’s commercial portfolio has traditionally focused on pharmaceuticals (e.g., its blockbuster heart failure drugs). However, the company continues to invest in cardiac regeneration science through internal platforms (like stem-cell-derived heart organoids), external cell therapy investments, and participation in research consortia.

8.2 Academic IP Foundations

A significant portion of foundational IP in cardiac stem cell therapy originates from academic institutions. These organizations have historically led research in cell differentiation, iPSC reprogramming, immunomodulation, and cardiac regeneration. Many of today’s commercial platforms either license from, or build upon, patents developed in university labs.

University of California (UC System)

The University of California system is at the forefront of cardiac regenerative medicine, with multiple campuses driving innovations from lab to clinic. At UC San Francisco’s Gladstone Institutes, researchers like Dr. Deepak Srivastava pioneered direct cellular reprogramming of fibroblasts into cardiomyocytes, leading to the spin-out Tenaya Therapeutics aimed at heart failure cures. Tenaya’s programs are translating reprogramming technology to regenerate heart muscle in patients and using stem-cell-based heart models to discover new drug targets. The University of California system holds 895 patent publications and 313 patent families related to cardiac stem cell therapies.

U.S. Department of Health and Human Services (HHS)

The U.S. Department of Health and Human Services (HHS) plays a critical funding and coordination role in cardiac stem-cell therapy research, primarily through NIH-backed networks and consortia. This includes the Cardiovascular Cell Therapy Research Network (CCTRN), which supports multicenter clinical trials of adult stem cells for heart disease across seven top U.S. hospitals (e.g., Texas Heart Institute, Stanford, University of Miami). CCTRN has enabled standardized protocols and comparative trials in ischemic and non-ischemic cardiomyopathy, myocardial infarction, and heart failure. HHS holds 466 patent publications and 212 patent families in the cardiac stem cell space.

Massachusetts General Hospital

Massachusetts General Hospital, through The General Hospital Corporation, is a key academic driver of cardiac stem cell research and translational application. Its Center for Regenerative Medicine (CRM) and the Gene and Cell Therapy Institute (GCTI) serve as institutional platforms for advancing stem-cell-based therapies for cardiovascular diseases. In collaboration with Harvard Medical School and Brigham and Women’s Hospital, MGH also supports technologies to generate embryonic-like cardiomyocytes and mini-heart organoids for disease modeling and drug screening. The institution holds 390 patent publications and 131 patent families related to cardiac stem cell therapies.

Harvard University

Harvard University – through the Harvard Stem Cell Institute (HSCI) and its affiliated hospitals – has been at the vanguard of cardiac stem cell therapy research and translation. The technology of hypoimmunogenic stem cells (genetically engineered human pluripotent stem cells was licensed to Sana Biotechnology, a startup co-founded by Harvard faculty, to enable off-the-shelf cell therapy products that won’t require immunosuppression. Harvard geneticists co-founded Verve Therapeutics to develop one-shot base-editing treatments that permanently lower cholesterol and reduce heart attack risk. Harvard holds 388 patent publications and 119 patent families related to cardiac stem cell therapies.

Memorial Sloan Kettering Cancer Center (MSK)

While MSK is best known for its expertise in oncology, the institution also plays a key role in advancing stem cell innovations relevant to cardiac repair. It supported the early scientific foundation behind BlueRock Therapeutics – now a Bayer subsidiary – which was co-founded by MSK-affiliated researchers. BlueRock is developing engineered pluripotent stem cell–based therapies for heart regeneration, including a preclinical candidate (BR-CM01) that uses allogeneic iPSC-derived cardiomyocytes to replace heart muscle lost after myocardial infarction and restore cardiac function. MSK holds 378 patent publications and 78 patent families in the cardiac stem cell space.

9. Who is investing in cardiac stem cell therapies?

Investment activity in cardiac stem cell therapy remains steady but selective. Most investor interest is concentrated around scalable platforms with off-the-shelf potential, particularly those built on iPSC technologies and automated manufacturing systems. Concerns about clinical translation, product consistency, and cost remain barriers to broader deployment of capital.

BlueRock Therapeutics has received one of the largest rounds in the field to date. In 2016, Versant Ventures led a $225 million Series A to launch the company in partnership with Bayer. BlueRock focuses on allogeneic iPSC-derived cardiomyocyte therapies and remains one of the most closely watched players in regenerative cardiology. Mesoblast has attracted major institutional investors including BlackRock, Morgan Stanley, and Oaktree, while BioCardia counts Vanguard, UBS, and Geode Capital among its backers.

In Asia, firms like HELP Therapeutics and Pharmicell have raised funds from investors such as Jolmo Investment, Ming Bioventures, Shinhan Venture Investment, and KDB Capital. Other notable companies include Secretome Therapeutics (backed by TEDCO and UM Ventures), Pluri Inc. (JPMorgan, Jane Street), and Vericel (BlackRock, Vanguard).

Across these deals, investors are prioritizing clinical feasibility, regulatory alignment, and platform scalability. High-cost, autologous platforms have attracted less attention, while allogeneic models with GMP automation and IP defensibility continue to draw interest from both venture and strategic capital.

10. Opportunities and Gaps

After more than two decades of development, cardiac stem cell therapy remains unproven at the commercial level. No product in this category has secured FDA approval. However, the lessons from prior trials have clarified where the next opportunities lie, and where structural gaps remain.

Top 3 Opportunities

- Allogeneic “Off-the-Shelf” Cell Products – Cardiac stem-cell therapies are trending toward allogeneic, cryopreservable lines. While the space is crowded and the race is intense, an off-the-shelf product can overcome the logistical hurdles and high costs of autologous approaches, making therapy more accessible.

- Novel Delivery Platforms – Although stem cells themselves aren’t new, there’s ample room to patent delivery systems – especially in targeted delivery and linker technologies. Focusing IP on scaffold formulations, crosslinking chemistry, and injectable biomaterial-scaffold protocols will protect these innovations.

- Integration & Monitoring Technologies – The delivery platform alone can’t be patented, but the technologies around stem cells hold prime patentable space – such as multiplexed readouts of unique cell tags or integrated sensor systems for real-time tracking of cell engraftment.

Top 3 Gaps

- Lack of Standardization – The unique nature of stem-cell therapies makes it very difficult to establish robust benchmarks. Heterogeneous delivery methods (intracoronary vs. intramyocardial) complicate cross-trial comparisons and regulatory approval.

- Insufficient Patent Coverage for Long-Term Tracking – Despite a surge in academic publications on advanced imaging and genetic tagging of transplanted cells, commercial patent filings in this space remain very limited. Strong IP here would support long-term efficacy and safety assessments.

- Limited Coordination of Patent Term with Data Exclusivity – Even with solid patent protection, therapies may benefit more from regulatory exclusivity (e.g., orphan-drug status). Synchronizing patent-term extensions with data-exclusivity strategies is crucial—yet often overlooked – in ensuring sustained market protection.

11. Conclusions and future directions

Cardiac stem cell therapies are entering a more focused and technically grounded phase of development. The unmet need remains significant. Heart failure continues to affect tens of millions globally, and current treatments offer limited benefit for patients with advanced disease.

Leading companies in this space are adopting tighter strategies. Clinical programs are more targeted. Manufacturing is increasingly automated. Partnerships now focus on delivery, regulatory engagement, and GMP scale-up rather than purely on discovery.

Investor interest is growing again, but with clearer expectations. Off-the-shelf platforms built on allogeneic cells or secretome-based approaches have drawn the most capital. Scalable manufacturing and regulatory alignment are now prerequisites for later-stage funding.

Still, the most critical challenge remains IP. Cell therapy platforms are complex, difficult to define, and subject to legal uncertainty. Many companies continue to treat IP as a secondary concern. The companies most likely to succeed are those that approach intellectual property as a central element of platform strategy—not as a legal obligation, but as a tool for protecting innovation, enabling freedom to operate, and establishing long-term advantage.

Disclaimer

The patent search was conducted using publicly available data. The results may not be exhaustive or fully capture the entire global landscape due to limitations in data access and coverage.

Methodology

This global IP landscape of cardiac stem cell therapies was constructed using PatentVest™, a proprietary patent intelligence platform that integrates over 195 million records across 106 jurisdictions (as of May 2025). The search strategy followed a three-step funnel: (1) identification of patents mentioning stem cell technologies, (2) refinement to include cardiovascular-related applications, and (3) focus on therapeutically relevant filings. After removing unrelated technologies, the final dataset comprised approximately 73,600 publications across 21,400 patent families from around 4,000 companies in 66 countries.

For further technical details – please contact us directly at [email protected]

Disclosures

PatentVest, Inc. is a wholly owned subsidiary of MDB Capital Holdings and an affiliated company of MDB Capital. Securities trading, account management, and investment banking services are offered by MDB Capital, a broker-dealer registered with the U.S. Securities and Exchange Commission, a member of FINRA and a member of SIPC.

The insights and analysis presented in this report were derived from IP Research work performed for Hemostemix, an active client of our firm. Readers should be aware of the potential for a conflict of interest or bias in this analysis. However, we maintain our commitment to providing accurate and objective insights based on thorough research of the IP landscape. We encourage readers to consider this disclosure when interpreting the information presented in this report.

All patent portfolio data and analysis in this report are based on publicly available information as of June 2025, sourced through PatentVest, our proprietary global patent database. While every effort has been made to ensure accuracy and completeness, the findings may not reflect unpublished, pending, or confidential filings. Companies may hold additional IP assets that are not yet publicly disclosed. This report should be considered a snapshot, not a definitive account, of current IP positions.

The analysis in this material is provided for informational purposes only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. The analysis presented herein focuses on intellectual property landscapes and related trends in the Cardiac Cell Therapy Market and is not intended to constitute research or investment advice. Any references to specific companies or technologies are provided for informational purposes only and do not constitute a recommendation by MDB Capital to buy, sell, or hold any securities. This material does not and is not intended to take into account the particular financial conditions, investment objectives, or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Information in this message from employees of PatentVest or an affiliated company is based upon information that is believed to be reliable. However, neither PatentVest nor its affiliates warrant its completeness, accuracy, or adequacy. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. Actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors.

To view a listing of important MDB disclosures, please visit www.mdb.com/disclosures. For additional information, please visit www.mdb.com or contact us at 945.262.9010.

REF: https://www.pharmaceutical-technology.com/news/mesoblast-eyes-accelerated-approval-filing-for-heart-failure-cell-therapy/#:~:text=The%20gold%20standard%20of%20business,intelligence

REF: https://www.fiercebiotech.com/biotech/mesoblast-defends-stem-cell-therapy-for-heart-failure-after-trial-miss#:~:text=The%20therapy%20did%20however%20allow,of%20recipients

REF: https://www.bluerocktx.com/the-science/programs/

REF: https://pubmed.ncbi.nlm.nih.gov/29024485/

REF: https://secretometherapeutics.com/pipeline/#:~:text=Our%20lead%20clinical%20asset%2C%20STM,DCM